A long while ago I sat down to do my first budget and was amazed at how much money our car was eating up. It’s often one of those necessary expenses that you never really sit down to do the maths on. Let’s face it, some of us probably would rather not know the true cost of owning our vehicles. But if we choose to live in denial we can find our car costs in more ways than one, and can deprive us from living a life we truly want.

Everyone and their dog seems to have a car these days and more often than not they come with that ever recurring five or seven year debt repayment. And I sure as hell am not innocent in this, I too, have had car loans in the past.

If you have the option to walk or bike or catch public transport in your daily routine – skipping the need for a car can be a huge budget winner! But for anyone else they are often a necessary expense.

So for those of you who do have a car let’s end the guesswork between what we think out car is costing us and what is actually is costing the budget!

Why you should calculate how much your car is really costing you

If you find yourself living pay check to pay check and wondering where all your money is going, a good step is to delve deeper into your budget expenses. Particularly if you have a loan on top of all the other vehicle costs.

Once you see how much of your income is going towards your vehicle you can make an educated guess with how to proceed. Maybe you’ll decide your car is costing you too much and you want to trade it in for a more fuel efficient one or one that is more affordable, or sell it all together if you find it will be cheaper to take public transport. Or you might find that the car you have is the right one for you and decide to keep it. These are important decisions that are often left when it is too late which can cause unnecessary stress and financial strife.

Calculating how much your car is really costing you

All the costs below will be reasonably close to my own car expense budgeted costs and in AUD. Of course these will differ for your personal budget but hopefully these will cover all your relevant expenses and give you an idea to work out How much your car is really costing you. I did leave out more specific costs like Tolls which you may or may not have to pay, so feel free to add those in as well if they are relevant.

Here are the main vehicle expenses you will face if you own a car or other vehicle.

- Petrol $50 a week ($2600/year)

One of the main costs associated with your vehicle is petrol. Especially if you have an inefficient fuel guzzler of a car.

Bank Statement Method

A good way to estimate your petrol cost is to check your bank statements for how much you have spent on petrol over the past 3-6 month period and to take an average e.g. $1500 spent on petrol over three months would mean your petrol costs on average $500 a month.

Tracking Method

If you have no clue of how much you have spent in recent months (you might pay in cash), take note for the next 4 weeks of what you spend in petrol and take the average weekly amount as your petrol estimate.

Average Fuel Consumption Method

You can also take the average fuel consumption of your car which you can find on car sites to calculate your approximate petrol cost, particularly if you are trying to assess the cost of petrol for a vehicle you want to buy and don’t know the costs already.

If you know the fuel efficiency of a car, how many litres (or gallons) it needs per one hundred kilometres (or miles) and if you know approximately how many kilometres (or miles) you get out of a fuel tank and the average price of petrol you can estimate the weekly costs as follows:

Petrol cost Formula =

(Total Kilometres per tank/100) (KM) x fuel consumption (L) per 100kms x average price of fuel ($)

So to demonstrate, if your car travels 650km on a full tank of fuel and your car consumes 7.6 Litres every 100 kilometres and the cost of petrol is $1.40

Your tank cost would be $69.16 [(650km/100km) x 7.6L x $1.40]

If that tank (in this example the 650kms) lasts you 8 days the daily cost would be $8.65 ($69.16/8) or $60.52 a week (7 days x $8.65)

Total Cost – Petrol $50/ $2600 a year

2. Maintenance Costs $250 Service $500 Repairs

Services

Most cars need regular services every 10,000 to 15,000 kilometres. Depending on how much you drive your car, this might need to be done every 6-12 months.

Services can range in price depending on your mechanic, vehicle type and if the car needs a minor or major service. If you take for a service at a big brand service centre it might likely cost you twice the price of a smaller mechanic, and if you are servicing your BMW versus a Camry, there will be a large price difference there too. My services generally range from $250-$500 AUD so I will just go with the lower estimate of $250 for my calculation.

Of course if you service your car every 6 or 9 months you will need to adjust your annual figure.

Total Cost – Services $250

Repairs

Repairs for your vehicle can also add up quickly and will need to be done as they are needed. You will need to replace tyres, brakes, fix oil leaks, cosmetic repairs and so on for your vehicle. Repairs will vary on whether you can DIY them or pay a mechanic. But a good conservative estimate to budget is $500 annually which might cover a set of new tyres which is the figure I have used for my calculation..

Total Cost – Repairs $500

3. Car Insurance (Fully Insured) $750 a year

If you are under 25 or a bad driver, this might look more like $1300 to you but lucky for me one of the only good things about getting a little older is your car insurance costs go down 🙂

Total Cost – Car Insurance $750

4. Greenslip (Medical Insurance) $650 a year

In Oz, we all must pay for Vehicle Medical Insurance which is called a Greenslip in order to register and drive our cars. It protects anyone injured in an accident and pays for their medical costs. My most recent one cost me about $550 for the year but let’s go with $650 as it can again vary with age and vehicle.

Total Cost – Greenslip $650

5. Registration $250

Once a year we pay car registration which is approximately $250 for a small car. For a wagon sized car this goes up to about $323 and up from there based in the size of your car.

Total Cost – Car Registration $250

6. Car Repayments

If you don’t own your car, you will of course also be paying car repayments which you need to add into your calculation. This is where a car can really blow the budget as you can see from the above expense inclusions, cars are costly enough without adding a loan repayment on top.

To demonstrate here is an example of a $20,000 loan at 7% interest rate over 5 years with a $10 monthly fee. The repayment would be 60 payments of $406 or $4872 a year for 5 years.

Total Cost – Car Repayments $406

How much is your car really costing you?

In the calculation below using the amounts we have detailed above as an estimate, this particular vehicle would cost you $822.67 a month or $9872.00 a year. On a $48k after tax income, this car would eat up an estimated 20.57% of after tax wages! And keep in mind these were very conservative figures!

I have calculated the above to demonstrate how much your car is really costing you so you can accurately predict vehicles and their associated costs in your budget. And so you can keep these in mind before making vehicle purchasing decisions so you can make the right decision for you.

By comparing how much of our after tax wages goes to cover vehicle expenses we can get a true picture of how much our car is really costing us. This might be the math we need to sell a car we can’t afford or make us think again before buying a new car with a huge loan to boot.

If you are finding it difficult to save money your car may be the culprit and this calculation will help you to identify if that is the case.

Hidden Costs

Of course the cost of cars does not end there, there are two more I wanted to touch on in addition to the above.

7. Lost investment returns

Now this one is something that you should consider as an opportunity cost for spending your money on financing a car. Of course cars cost money every month and some of those costs are unavoidable, but that cost is exacerbated when you buy a car on finance. Financing a car should really be a last resort and I am going to show you why.

Imagine if instead of borrowing $20,000 on a new car that you had convinced yourself was affordable, with a $406 monthly repayment, you instead invested that money. Now let’s say you invested that money into your Superannuation or 401k from age 30 to 65, a total of 35 years at 8%. When you are 65 you would have accumulated, thanks to the magic of compound interest – $931,316!

And that is just from investing your car repayment each month from age 30 to age 65. Not adding $1 over that a month to your retirement account. Imagine if you invested your car repayment that is $100 a month! We are literally throwing money away like it’s going out of style and future you is going to pay the price to now you can have a slightly nicer car!

And cars are money pits. Take it from a girl that just had two cars damaged by hail on the same day and had to fork over $1600 for an insurance claim. (I am certainly feeling the pain of vehicle ownership at the moment!)

So the next time you see a $20,000 or $30,000 car I want you to pause. Forget for a moment how ‘cheap’ the car is and how great it will be to drive around in it and calculate how much that car will truly cost future you with this calculator before you even walk into a car yard and even think about signing for anything.

8. Depreciation

Lastly, I wanted to highlight the cost of depreciation, which isn’t someone most people think about but as an Accountant and self-confessed nerd I must include this one. Cars lose a crazy amount of value as soon as you drive them out of the car dealership – everyone knows this and I’ll try not to bore you too much.

It something that should be taken into account. I did my own calculation on my car, which I did buy brand new back in 2016 (my first and most likely last new car purchase especially after above hail incident mention) and in the space of two years my car has depreciated by 25% or the equivalent of $5000 – $2500 a year. That is a lot of money to throw down the drain! Which is exactly why so many finance experts preach that if you do buy a car, buy one that is second hand and let someone else pay for that early depreciation.

Calculating your vehicle Depreciation

You can check your car valuation at Kelley Blue Book (US readers) or Drive.com and look up your car to see what it cost when it was first released and what it is now worth to calculate your approximate depreciation amount to date.

So if you bought a 2012 Camry for $25,000 and in 2019 its market value is $12,000 your car depreciated approximately $13,000 over the past 7 years – approximately $1000 a year.

Of course all cars depreciate but it doesn’t hurt to take this into account when deciding on a car. Particularly if you are someone who does a lot of kms with your car and you will destroy the value of your vehicle a lot quicker than someone who only does 10,000km a year with theirs.

And there you go, you are now hopefully armed with a little more information on how much your car is really costing you and how to make educated budget decisions when it comes to your vehicle!

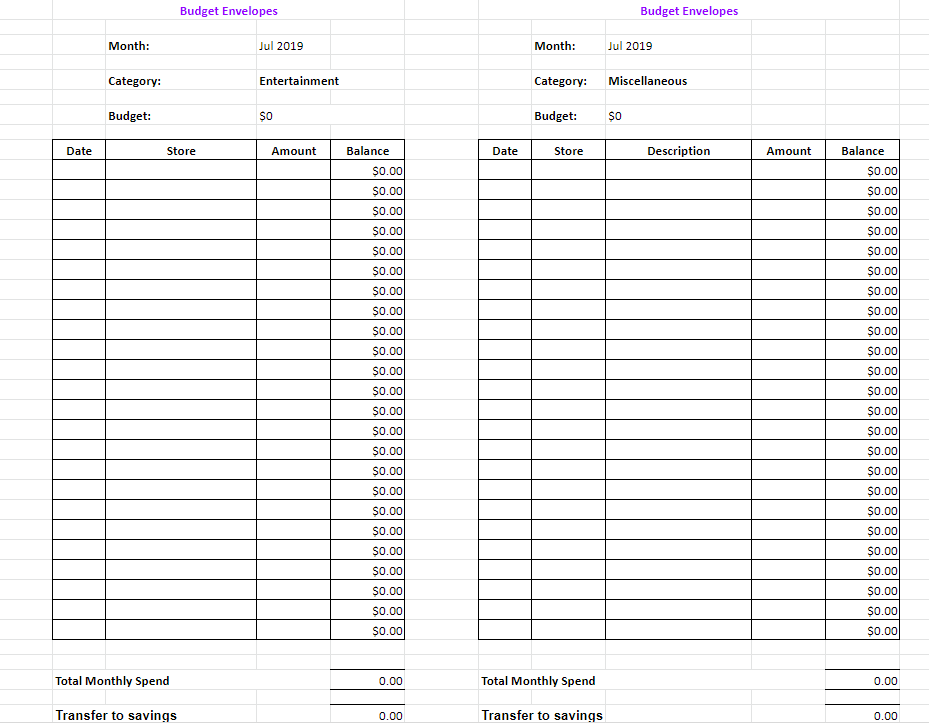

If you want to calculate what your car is costing you you can download my Car Expense Calculation Worksheet. Simply download a copy from Google Sheets and fill in the monthly or annual column for your expenses and your After Tax (net wages).

This week’s comment question: Do you have a car repayment? Do you own a car/s or did you opt out of them all together to save money? Let me know in the comments below!

[Photo: Oli Woomdan @ unsplash.com]

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()