About a year ago, I stumbled upon J Money’s blog Budgets Are Sexy, a now favourite finance blogger of mine who openly tracks his Net Worth on his website. I was instantly amazed at how he tracked everything and monitored his families financial progress month to month, year on year.

At the time of discovering his blog I wasn’t tracking my Net Worth and hadn’t really ever given much thought to it. I figured as long as we were ahead on paying off our mortgage and avoiding adding any other debts and had enough to cover our bills each month we were doing okay. And maybe we were, but I’d seen a whole new way of tracking finances and I wanted in!

Of course I knew our rough debt and savings balances and checked our Superannuation balances when we got our bi-annual statement, but I didn’t know month on month how much our Net Worth had increased or decreased.

Since then, May 2017 I have been recording our Net Worth figures each month, and was amazed to see that over that 12 month period our Net Worth had increased by 13%! It has been a huge motivational tool for our finances as we watch our debts slowly decrease and see that Net Worth figure slowly inching up each month.

And the most awesome part of it all is it is not a time consuming process. It takes a whole 10 minutes a month! That’s it! Which is totally worth it to know where you are at financially and how you are tracking towards each of your financial goals!

If you have been considering recording your Net Worth and weren’t sure how to get started, I am writing this post for you! Check out my Beginners Guide To Tracking Your Net Worth!

Why you should track your Net Worth

Before we start any goal we need to work out our why, that is, the reason behind the effort we need to put in. So many of us go to work for forty or more hours, week after week and have no goal or plan for the money we bring home. It just slips through our fingers, somehow every last dollar is spent, often without any idea of where it went. Month after month, there is nothing left over to save or invest for your future. Retirement is something that is put on permanent hiatus until 40 or 50. Which may not seem like a big deal but you are losing a good 2 to 3 decades of growth you will never be able to get near once you leave yourself only a decade to build your wealth. The time to start building wealth for your retirement is now, or as soon as possible.

By tracking your Net Worth your spending habits are right in front of you in black and white on the page. If you spend all your pay check you’re $0 bank balance will make it blatantly obvious that you have nothing to show for your hard work. If you are swimming in debt and your Net Worth seems to be going backwards, not forwards again you will see that you are not building wealth but doing the complete opposite. Until you see the numbers staring you in the face it can be hard to see where you are financially and what your financial goals are. Having your assets and liabilities laid out in front of you can help you identify the need to change your current spending habits and create a more secure financial future. It can help us to start being more intentional with out money and motivate us to make better choices.

Now think about your why and make a list of the top three reasons you want to track your Net Worth.

Some reasons to track your Net Worth could be:

- To grow your wealth so you can retire comfortably in the future and not be stuck working until you are 70 or older

- Enable you to keep track of your debt balances so you can work towards paying them off faster

- Set targets to aim for to help motivate you save and pay down debt

Now that you know your why for tracking your Net Worth we can get started on How to Track Our Net Worth.

How to Track Your Net Worth

There’s nothing scary when it comes to tracking your Net Worth and you’ll soon wonder why you weren’t tracking it all along. All you need is a simple accounting rule:

Net Worth = Assets – Liabilites

That is really all you need to know to get started. When we track out Net Worth we simply need to list our assets and liabilities and the difference is our Net Worth. If your Assets are higher than your Net Worth you have a positive Net Worth, if your liabilities are higher than your assets, you have a Negative Net Worth. Now I will go into a little bit about what Assets and Liabilities are and how they differ.

Assets:

Assets are all the things that make you money and that can be sold off for cash. They include things like savings accounts, term deposits, Superannuation or retirement accounts, property, vehicles and stocks or bonds.

Of course you may have other assets like jewellery, art, tools, furniture etc but we are going to ignore those for simplicity as their value isn’t as easily estimated or guaranteed. We just want to focus on the most liquid assets (that’s just accounting speak for assets that are easy to turn into cash!) that we can accurately estimate their current value.

Liabilities:

Liabilities are the things that cost you money and involve you paying money to someone else. These include mortgages, student loans, cars loans, personal loans, credit cards, pay day lenders, after pay, overdrafts or anyone else you owe money to.

What to Include in your Net Worth Calculation:

As described above, we are going to list any Assets and Liabilities at their current balance at the end of each month to calculate our total Net Worth. That is the balance at the 30th or 31st of the month, depending which month you are in.

ASSETS

Here is a list of Assets you might include in your Net Worth Calculation.

CASH

Bank Accounts – List all your bank accounts and any term deposits at their current balance. This might include your Everyday transaction Account, Emergency Fund, Savings Accounts etc.

PROPERTY

House & Land – List any land or property you own at the current market value. For a more accurate estimate you can contact a real estate agent in your area for a market appraisal or you can do an estimation based on what similar homes in your area are selling for.

Vehicles – Use a car valuation website like Drive and Kelly Blue Book to get the current value of your car. Be sure to review the odometer reading of your vehicle and adjust the valuation if your vehicles odometer reading is higher than the valuation odometer reading range.

I like to be extra cautious and take the lower private sale value of my vehicle and take off a further amount of say $1000 if I know that my car is not in excellent condition. It doesn’t have to be an accurate estimation of course, but you want it to be a reasonable estimate of what you could sell the vehicle at today.

INVESTMENTS

Superannuation/Retirement Accounts – List your Superannuation or Retirement Accounts and your current balances here.

Stocks & Bonds – Here you will again list the market value of any current stock or bond holdings you have. This is a great way to monitor how they grow over time.

LIABILITIES

Mortgages – List any mortgages on your home, land or investment properties that you have at the current balance of the loan. This will offset the value of your asset to show you what Equity you have (e.g. your current home value less what you still owe on your mortgage).

Credit Cards – List each credit card you own and the end of month balance of each. Your current balance will be listed on your online log in portal or your most recent credit card statement.

Car & Personal Loans – Check you car and personal loan account for the current balance of your loan. Don’t forget to include the vehicle’s current value in the asset section to offset the loan balance to give you your vehicles true Net Worth.

Student Loans – List your current student loan balance/s.

For any Aussies reading this, HELP-DEBT is wonderfully difficult to know what you owe month to month as you only get a statement once a year with your tax return. For our Net Worth calculation we just took the HELP debt balance to be the prior June 1st balance which you can find on your most recent HELP-DEBT statement and just carried that across for the year until we had the new updated statement.

Other Credit: List any other debts you have here. These may include After Pay balances, overdrafts, pay day lenders any money you owe to friends or family or anything else.

For help on how to minimise your debts once and for all check out: How the Debt Snowball Can Get You Debt Free Faster

Once you have all your assets and debts listed you can now calculate your total Net Worth for the month by taking away the Total Assets from the Total Liabilities.

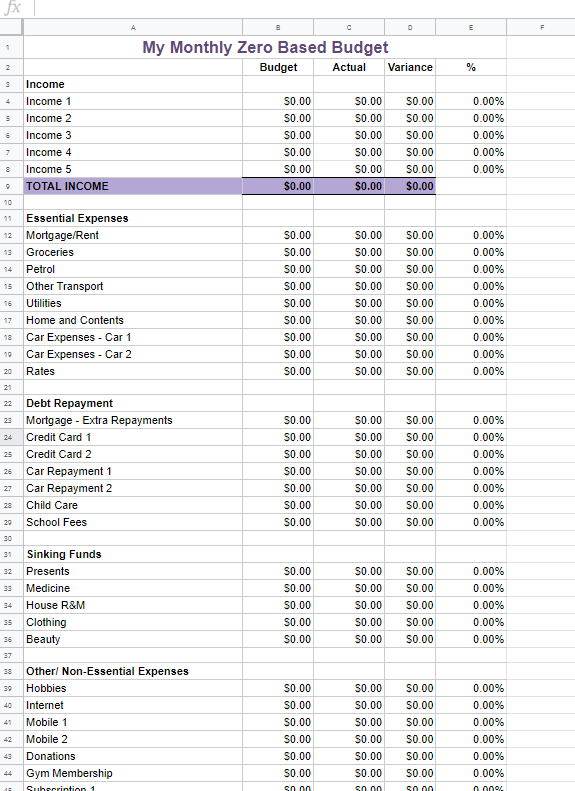

If you want even more simplicity, this Net Worth Worksheet available in my Etsy store will take any work out of preparing your own Net Worth file. Simply enter your relevant categories and figures and the worksheet will do the rest for you!

Don’t forget to set a reminder on your phone calendar or in your planner to do this at the end of every month, or as frequently as you like so you remember to do it and build the habit!

You’ll be just as excited as I was to see how you had progressed in 12 months time. And there is nothing that will help you stay motivated to eliminate debt and grow wealth more than tracking your Net Worth!

This weeks comment questions: Do you track your Net Worth? What made you start tracking it? And do you find it helps you stay motivated with your budget and financial goals? Let me know in the comments!