**This post contains affiliate links. If you make a purchase of a product from the links in this post I will receive a small commission, at no cost to you. This allows me to keep my blog advertisement free and support the running costs of my blog. I only recommend products I believe will add value to others and that I love myself.**

Have you ever felt overwhelmed by the financial stresses in your relationship and struggled to effectively communicate with your partner about budgeting and finances? *Raises hand*. Financial discussions with your loved one can cause stress and anxiety, but if left unresolved can cause more serious financial woes and long term unhappiness in your relationship.

Maybe you are the one who carries the bulk of the financial stress on your shoulders because you feel your partner has enough to worry about? Perhaps your partner doesn’t want to hear about financial issues or they don’t even know there are issues as they assumed you have everything under control? By being open an honest with each other you can remove the guesswork out of your financial security and get the reality of your finances out in the open so you can both start working together on a plan of attack.

Money can be one of the biggest make or break things in a relationship. Relationships Australia 2015 survey found that 7 out of 10 couple report relationship tension as a result of financial woes and stress. Finances are not something that should be pushed under the rug or left alone to cause endless stress in your relationship. Ignoring them will not make the bills disappear but make them harder to deal with when the time comes to pay them… and it will come.

Even though at first, it may be a difficult and awkward subject to discuss in the beginning, you will have more of a chance to achieve your financial goals when you are both on the same page working as a team. Don’t struggle alone when you can both be working together tackling your debts and achieving your savings goals head on. Just like having a gym buddy to hold you accountable for going to the gym and finishing a set, having your partner on your team will help keep you accountable to your financial goals.

Even if you aren’t married and have separate finances that doesn’t mean that you can’t both be on the same page when it comes to money and will certainly give you a head start if you relationship does progress to something more down the line.

Here are they are: 9 Tips On How You Can Communicate With Your Partner About Finances.

How to Communicate With Your Partner About Finances

1. Set a time to meet and discuss finances

Avoid leaving financial discussions with your partner to what you can yell over the TV ad or what discussion you can get in before you are interrupted by the kids. The best way to communicate with your partner about finances is to plan some time to get together and talk about your future goals and current finances in a quiet place so you can both focus and not be under other pressures or distractions. It can be be a over a home cooked meal when the kids are out for the night or morning (if you have kids) or out on a date night over dinner, it doesn’t matter just find a spare hour somewhere in your schedule to chat about your finances.

Don’t forget to let your partner know in advance that the purpose of meeting is to discuss about finances so they aren’t blind sided. After the first one, make it a regular gig. Set a monthly reminder to sit down for half an hour to talk about your budget each month and how you are progressing towards your goals.

2. Approach the conversation from an understanding and non-judgmental zone

When you try to open a dialogue and communicate with your partner about finances, don’t assume the worst or treat the meeting as an opportunity to bring up every unacceptable expense (in your eyes) that you have been bothered by in the past. You may find that your partner actually agrees with you on getting your finances in better shape and completely acknowledges what your financial problems are. They might have even been thinking the same thing and weren’t sure how they were going to bring it up with you!

Sometimes they are even aware of their own spending problems but don’t know how to change their spending habits and need a plan and your support in order to help keep them on track. Approach any conversations calmly and with the intention to work as a team, not go on the attack and lay blame on your partner. Acknowledge that you might even have your own over-spending areas that you need to work on and be honest about these to your partner. Leave the mistakes in the past, and focus on what changes you can make in the future to reach your financial goals.

3. Know your why

Get on the same page with your goals. Budgeting isn’t meant to be about torturing yourselves indefinitely and saying no to anything and everything that is non-essential expenditure. It is about making your goals and dreams come to life. How far away that is will depend on your current state of finances. If you are swimming in credit card debt and other loans with little in the savings account it may take a while for you to see that you are making progress on your debts but you will get there with a little bit of determination. And there is nothing more motivating that having future plans written down and at the forefront of your mind. These goals are what are going to keep you on track during those times when you want to quit.

Write down your joint future goals:-

- Do you want to go on a family holiday next year?

- Be debt free so you or your partner can cut back hours at work or for you to spend more time with the kids?

- Are you wanting to stop living week to week?

- Or remove the anxiety you feel about your finances and get an emergency fund built up?If you are both on the same page you will have more motivation to stick to your financial plan for the long haul. Put your goals somewhere where you can see them such as a Financial Vision Board or on the fridge so they are there to remind you of why you are doing this.

4. Acknowledge the finance problem areas

Now that you’ve got your financial goals written down and you’re excited to take the next step in your financial freedom journey, it’s time to acknowledge the problem areas. If you are hiding debt, bills or anything from your partner, now is the time to come clean. A genuinely honest relationship includes being open an honest about any debts that you may have or spending habits that you know are not helping you achieve your financial goals. If there are any pressing financial issues bring them up and be ready to hear them. Take a deep breath and appreciate that your partner is being honest with you and starting to communicate.

Acknowledge that your budget issues are not going to be something that you can fix in a night or a week, or possibly even a year. This is going to be a long-term process that will take time to work at. Be patient with each other as you slowly replace your less-than-ideal spending habits with more intentional ones.

A good place to start is reigning in the expenditure that won’t hurt so much. Cancel unwanted gym memberships or subscriptions to services that you are no longer using, make more of a conscious effort to save electricity where possible, renegotiate your mortgage to a lower rate and commit to only shopping once a week to reduce the amount of times you are stocking up on groceries. None of these measures leaves you feeling any extreme budget pain but the savings will give you a super helpful boost to paying off those debts and speeding up the debt repayment process.

As you progress in your financial journey you can move on to tackling those not so easy spending problem areas. Consider how you can reduce any excessive spending on areas such as:

- Overspending on clothing, shoes, accessories

- Regular costly dinner outings

- Car repayments that you cannot afford

- Spending on hobbies that is costing large sums of money

- Buying coffee multiple times a day, every day

Don’t try to tackle the problem expenditure all at once. Pick one and go from there. Maybe this month instead of buying coffee each day you could bring your own from home or make one at work. Next month you can limit your expensive dinners to once or twice a week and cook at home more. The following month you could adopt shopping at thrift stores instead of buying everything brand new. These small changes may seem unimpressive on their own, but when you add all those savings together it can really add up! Over time you will build your budgeting muscles and find new ways to save.

5. Plan your budget

Your budget needs to be something your partner and you both agree on. Think of it like taking on a new commitment, you both have to sign on the dotted line. By leaving your partner in the dark about finances they may think things are rosier than they are and that is not going to work now that you are a team! With the numbers in black and white you can both be on the same page and work together to dodge any budget pressures that come up.

Don’t misconstrue that being on a budget will suck the joy out of life. It is a tool to make your life easier, with the end goal being what you want it to be! More time, regular holidays or an emergency fund, whatever your financial goals are. Be sure to allow individual and joint fun money in the budget (we’ll go into that below) to ensure your budget is realistic and that you will not set unrealistic expectations and fail before you start.

Over time you will get better at finding frugal ways to have fun such as going for a long walk or bike ride together, inviting your family over for breakfast, going to the beach or inviting friends over for a night of board games. If you think you can’t have fun without spending money you have tried hard enough 🙂

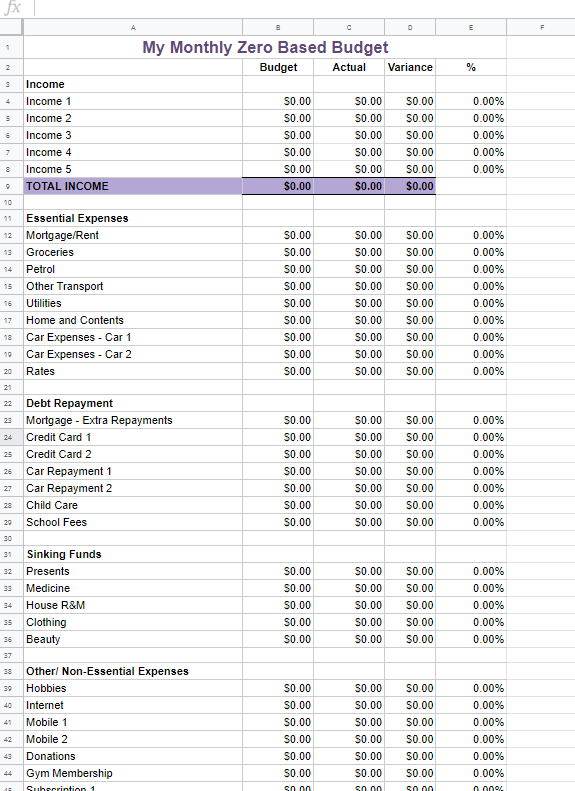

To help you get started, you can download my Budget Worksheet here. Don’t forget to include those often missed budget expenses like your Spotify and Netflix membership, house repairs or beauty treatments!

6. Set an allowance for you and your partner.

This is a great tool and bound to save you lots of arguments over spending by yourself and your partner that you both probably will never agree on (I am a non-coffee drinker, the hub loves his daily coffee, I’ve come to terms with it ‘;)). We are all individuals, with our own interests, hobbies and wants, use this allowance avoid explaining to your partner every purchasing decision you make.>

Having $0 for ‘free spending’ to do as you wish is not going to work, nor is questioning every dollar your partner spends. Set an allowance based on what your budget will allow. It could be $50 or $100 a week to spend each, whatever you both agree on and stick to it. This gives you and your partner the autonomy to spend it as you see fit. If you have kids you can add in a small allowance for them, it will be a great start to teach them about budgeting and saving!

It also takes some of the guesswork out of budgeting and makes it easier to stick to your goal. Withdraw your weekly allowance in cash or keep it in a separate account for each of you so it is easy to keep track of. Simply check your wallet or bank balance and you will know what is left. Great for those who aren’t that great at keeping track of their spendings or remembering to enter them into an app or notebook. Of course if you don’t spend it all you can save it up to buy something you really want down the line!

At the same time set up a joint spending account and allowance so you have some money each week to go out on a date night or day, or to catch up with friends. After a while you will get into the routine of what you can and can’t afford and sticking to your budget will become less of a struggle.

What about expensive hobbies?

If you or your partner have some big spending categories, this might also be a good time to set other budget allowances for those expenses to keep them in check. If you love shopping for new outfits, maybe you can set yourself an annual allowance on what you are allowed to spend on clothing. This can work for any expense; concerts, hobbies, beauty, new tools etc. This gives you the permission to spend guilt free on those items when they are in budget and helps to keep you conscious of when you are overspending on those categories.

7. Be considerate and honest

I’ve heard horror stories of partners going out and buying new cars without speaking to their spouse first. This kind of thing makes me cringe. Agree to avoid making large spending decisions without consulting with your spouse first. If you have shared finances and even shared debt, you should both be on the same page with spending. It can be helpful to agree on a threshold as to what you need to discuss together before buying something.

You don’t have to ask permission to buy every single item, how exhausting would that get! I’m suggesting to consulting your partner before buying those more expensive items. Such as a new appliance, phone or piece of furniture for the home. Even ignoring the financial aspect, it can’t hurt to ask for their opinion on something you want or need they made have some great advice or suggestions to offer, and it is particularly handy if it is something for your home (I’ve certainly unknowingly bought some things home that were deemed “ugly”).

8. Get Educated

Open your mind to new budgeting tricks and tips and financial strategies. If you are short on time listen to an audiobook on your commute to work or on your next shopping trip – wherever you can. I recommend listening to (or reading) Scott Pape’s Barefoot Investor and Dave Ramsey’s Total Money Makeover which have some great strategies to get your started on your new financial journal.

It’s something that might get you more open to talking about finances with your partner and get you both excited about your new financial path! If your partner wouldn’t date touch a finance book, don’t push the issue. You can sometimes effectively communicate with your partner the message of what you are reading just by discussing your favourite parts of the book with them.

If you sign up for my mailing list you can also get your free copy of my eBook “101 Ways to Save Money Whilst Still Living Awesomely!”. Reading about finances might not be the most enjoyable thing for everyone but listening to a few financial gurus will open your eyes and ears to things that may make achieving your financial goals that much quicker!

9. Be patient

You might not be on the same page at day one or day 100. Sometimes people need more time to grasp new ideas and lifestyles and long-term support in order to do so. I’ve listened to many Dave Ramsey Debt Free Scream stories where people had read the Total Money Makeover books years earlier and yet only started to change their habits after years of thinking about. Or it took their partner longer to get on board but once they were they were a strong team.

It might not happen as quickly as you would like but over time you will learn how to effectively communicate with your partner. In the meantime you can always lead by example and start making changes to your own spendings such as reigning in grocery spending, skipping the drink at lunch and just bringing your water along with you and finding more frugal ways to catch up with friends such as skipping lunch and going for a walk instead.

Find what your partners passion is and what they will be willing to change their financial habits for. Go back to your why and find out theirs. Sometimes the only thing they need to hear is that it would make your family more financially secure and both of you happier to get them motivated to start on the financial journey with you.

Don’t forget to be a little flexible. Maybe your loved one won’t give up their monthly gym membership for the budget, their Audible membership or their daily coffee but hopefully they will be willing to make other changes to get you to their goal and be more proactive in reducing expenditure such as taking more notice and filling up on cheaper fuel days or cancelling their unwanted memberships.

When the above measures aren’t helping

Of course there are instances where no amount of discussion or understanding can get your partner on board with your financial goals. If your efforts to budget and get ahead are met with constant resistance you may need to consider other issues that are present. If your partner is facing issues with addiction e.g. drugs, alcoholism or gambling, attempting to adjust your budget may not be met with encouragement and make your efforts come undone.

I won’t go into that situation in too much detail as this is a finance blog and I am no psychologist, but I will mention that if you partner is constantly resisting and attempting to tear down your efforts to get ahead, that it may be time for them to seek help with those issues, or for you to reassess the relationship and whether it is in line with your long-term values. This article written by The Minimalists may help you with how to approach a relationship with deteriorating communication.

Do you have any tips for how to effectively communicate with your partner and approach budget and finance conversations? Please share them in the comments below 🙂

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()