I’ve listened to hours upon hours of financial advice from finance gurus like Dave Ramsey, Scott Pape and Chris Hogan and the one thing that gets repeated again and again is the importance of paying off your debt so you can start building wealth. This is simply because when we don’t have any repayments we get to keep our pay cheques. Sure there are still bills to pay bills will always be there, but when you have no debt: no credit card repayments, no monthly car repayments and you own your home you have more of your pay to keep and to make your money work for you. And with the most recent rise in mortgage interest rates which are predicted to keep going up after a long stint of interest rate drops, it’s extremely important to try and pay off your mortgage faster whilst the times are good.

Let’s imagine this following scenario.

You buy your first home when you turn 30. With a 30 year mortgage term you are going to be putting a large chunk of your pay, often more than 25% of it towards towards paying off that mortgage until you are 60.

Imagine if instead of paying your mortgage off in 30 years you could bring it down to 15 years and own your own home by 45 instead of 60. And if you buy your home later in life, or through other circumstances you didn’t get to pay off as much of it as you would have liked, think of how great it would be to own your home before retirement. Future you is going to be super happy with you.

There are many financial and lifestyle opportunities that open up when you not longer have to pay off a mortgage. These include:

- Being able to reduce your workload from full-time down to part time, or completely changing careers to something you love even if it doesn’t pay as much as your last job.

- Being able to retire early

- Eliminating a house or rent payment altogether from your budget

- Being able to travel to your dream destinations

- Having the extra cash to help your kids with college

- The freedom to spend more on you

Who wouldn’t want those things!

But I want to have a life now!…

I often hear people say they’d rather enjoy their life whilst they are young then worry about debt later if at all, but this doesn’t have to be a one or the other scenario. Paying off your mortgage doesn’t mean having no life for the next ten to fifteen years. It’s certainly possible to find a balance between enjoying life and paying off your mortgage. It certainly won’t be without it’s sacrifices, but if you get a little creative and focus on some savings methods that don’t require you to miss out on anything such as making sure you are getting the best interest rates available you can get that mortgage paid off with much less pain than you think. Let me help you with how.

Check out 13 Proven Ways to Pay Off Your Mortgage Faster so you can have a life and be debt free – house and all much sooner!

**This post contains affiliate links. If you make a purchase of a product from the links in this post I will receive a small commission, at no cost to you. This allows me to keep my blog advertisement free and support the running costs of my blog. I only recommend products I believe will add value to others and that I love myself.**

13 Realistic Tips to Pay Off Your Mortgage Faster

- Make extra weekly repayments

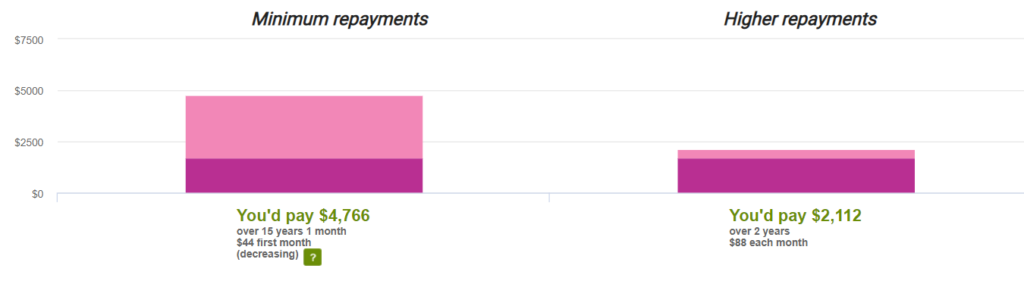

Unless you want to spend the next 30 years or so with a mortgage, and paying for your house three times over with interest added on top, don’t settle for paying the minimum repayment on your mortgage. It is as it indicates, only the minimum you should be paying. Every little bit extra you can throw on top adds up.

Even if you don’t have much to add to your minimum repayment minimise what you can in your budget and redirect that money to your mortgage. Check out these tips to save money and my eBook 101 Ways to save money for ideas on how you can free up some money in your budget to pay off your mortgage faster.

On a $400,000 mortgage at 4% with a 30 year term, and extra $20 a week shaves off $26,367 in interest and 2 years and four months. Throw $50 a week on top of the minimum and that increases to a saving of $57,555 and 5 years and 3 months! Those are some serious time and cash savings! You can calculate your own repayments with this awesome calculator here.

Don’t forget to pay your mortgage weekly, over monthly to save again on your monthly interest.

2. Utilitise all extra money

One of the best ways to pay off your mortgage faster is to utilise those lump sums. Instead of buying a new TV with your tax return, bonus or any other sums you come into, take that chunk of cash and use it to smash down your mortgage term. Tax returns, bonuses, inheritances, gifts and so on can go a long way to reducing your mortgage balance.

Again life doesn’t have to be miserable to get ahead, if putting all your bonus feels too torturous, that’s fine you can still treat yo’self a little, take 10% to spend on something you want or need and put the other 90% on the mortgage. Or work out a split that works for you and make it a habit. Keep in mind that it’s helpful if you can throw any lump sums you get onto your mortgage as early as you can. This will knock the interest bill down much faster.

Check out how the Debt Snowball can help you get debt free faster!

3. Avoid adding to your mortgage

It can be very easy to gradually increase your mortgage over time. You start with your first home, five years later and with a couple of kiddies you decide your humble abode isn’t big enough and you take on a bigger mortgage. Next you’ve refinanced your mortgage for a new car and a kitchen and bathroom reno. Before you know it your mortgage is more and more difficult to get on top of. Refinancing can be a slippery slope where it become too easy to just refinance every must have into your mortgage and make it that much harder to pay off.

Instead, save up cash to pay for repairs or upgrades to your home or at least make sure that your new mortgage repayment is still within the 25% of your after tax income range. With that threshold in mind you can avoid letting your payments get over your head.

4. Sell your unwanted stuff

If you are finding your home is getting a bit cluttered, make some space and some extra cash to pay off your mortgage faster by selling your unwanted stuff. You’d be amazed by what money you can bring in from treasures collecting dust in your home. Check out how I made $5,000 selling my unwanted clutter here.

5. Stick to a budget.

“A budget is telling your money where to go instead of wondering where it went.”

― Dave Ramsey

Wise words from Dave Ramsey. If you don’t know where your money is going you aren’t going to be able to spend it with intention. By sticking to a budget you can make sure you are spending money more efficiently which leaves more to throw onto your mortgage. You can then go even further once you’ve got the hang of a budget, and transfer any spare cash in your monthly budget that you didn’t end up spending such as unspent grocery money to put on your mortgage. Every dollar counts.

6. Get creative with fun

Having a goal to pay off your mortgage doesn’t mean that life has to be boring. Find free or affordable ways to have fun and stretch your dollar. Make a three course meal at home instead of going out. Look for vouchers and online deals for activities to get buy one get one free offers or other discounts. Go for a walk with a friend instead of getting a coffee. Ask family to buy your kids memberships to the museum or zoo in place of other gifts so you have free entertainment all year. Learn to appreciate things in life other than shopping and eating out. There is plenty of free fun out there to be had 🙂

7. Take advantage of Mortgage Offset Accounts

Offset accounts are a great way to reduce your mortgage interest bill without having to actually pay the money on your mortgage. When you are picking a home loan make sure to find one that has a 100% offset account to save you on your monthly interest bill.

The way it works is, any money you have in the offset account linked to your mortgage will offset the interest you pay on your mortgage. So if you had a $200,000 mortgage and you had $10,000 of savings in your offset account, the interest on your mortgage would only be applied to $190,000 of the mortgage not the full balance.

With saving accounts interest rates around the 2.8% mark versus mortgage rates around 4% it is a great way to get more bang for your buck. An added bonus, as the debt savings are not income it’s tax free savings.

So let’s say continuing from the example above, you had $10,000 saved for an Emergency Fund and your mortgage rate was 4%. By letting that money sit in your offset account, you would reduce your interest bill by $400 a year. If you had put it in a savings account paying interest at 2.8% you would have only made $280 in interest and would have to pay tax out of it.

If your current mortgage doesn’t come with an offset account shop around for a better home loan that does include it so you can tap into those amazing savings!

8. Review your interest rate regularly

There are huge savings to be had from your interest rate alone. If you aren’t checking yours against your banks competitors regularly you are potentially missing out on savings of thousands of dollars per year and tens of thousands over the life of the loan.

A $400,000 home loan with a 30 year term at 4% is $440 a week versus $467 at 4.5%. If you were paying the higher rate you would be missing out on a whopping $1404 a year in interest savings. And if you are paying a much higher rate then advertised you are losing out even more.

If you find your banks rate isn’t a competitive rate or they are offering new customers a better deal call up and ask them for a better interest rate. Do your research first. If they won’t budge, consider switching banks. Don’t reward banks that are doing their best to rip you off. Finding a mortgage that is a better rate let’s you pay off your mortgage faster without you having to cut back your budget to do so.

And if your bank charges you a monthly fee for your mortgage if might also be worth changing. A $10 monthly fee might not seem like a drop in the ocean but if that $10 monthly fee was invested at 8% over the same 30 year term you could have had $15003. Doesn’t sound so small now 😉

9. Get motivated

One of the most helpful things that will help you pay off your mortgage faster is to get motivated and in a mindset to smash that debt. Even if you don’t know anyone who can support you in person you can always find others who are tackling similar goals in trying to pay off their debt. These are just a few ways to get yourself motivated to tackle your mortgage and help you stay focused in your financial goals:

- Take notice of the interest you are charged each month. Instead of feeling bad about how high it is, watch it decrease month to month.

- Calculate how much of your original mortgage you have now paid off as a percentage. (Original Mortgage-Current Balance)/Original Mortgage = What % you have paid off.

- Print off a Mortgage chart at Debt Free Charts to colour in each time you hit a new goal.

- Look at how much interest offset you are receiving each month thanks to your offset account. This will also encourage you to save rather than spend your money so you can save on even more interest 😉

- Check out Dave Ramsey’s #debtfreescreams segment on YouTube for inspiration and to see how other people just like you finally paid off their debt or mortgage.

- Get some support behind you. Find a friend, family member or your partner so you can hold each other accountable and motivated each other.

- Check out the #debtfreecommunity on Instagram for other people who are in the process of repaying their debt tips, advice and motivation to keep you on track.

- Read books like Scott Pape’s The Barefoot Investor and Total Money Makeover by Dave Ramsey to help you with developing a plan to tackle your debt.

10. Increase your income

Find out what you need to do to increase your income outside of side hustling and doing overtime. If you complete a course can you get a promotion? Can you get a new position with further study? Can you smash your KPIs at work and get a good raise or make the EOY bonus? Maybe you could find a better paying job if yours doesn’t offer any salary increases or opportunities for a promotion and negotiate a much higher salary at the interview.

11. Get #Hustling.

If getting a raise from work isn’t on the table at this moment, get creative and find ways to bring in more income. Other than selling your unwanted stuff, there are many other options to bring in more money. Consider taking on more overtime when you can, or take on a second job, even if it is just temporarily. It doesn’t have to be something mind numbing, use your talents. If you are an artist or good at crafts sell your work on Etsy, if you are a teacher or can teach anything you can tutor or coach on the side. Pick up some work on sites like Airtasker if you have some spare time or rent out a spare room on Airbnb to bring in some extra cash. You can even get paid good money for walking dogs, talk about winning if you love the outdoors and dogs!

The more you earn the more you have left over after expenses and can inject that straight into your mortgage.

12. Stop lifestyle creep

Do you remember a time when you easily lived off a small wage in your early 20s? With each pay rise you grew accustomed to earning that higher amount in a matter of a few weeks. Before you knew it, it seemed like your pay rise had disappeared and you didn’t have any extra to save or pay onto debt.

Instead of allowing lifestyle creep to happen, give yourself a reasonable amount to spend each month and resist increasing it each year. You’d be surprised how quickly you get used to spending a limited amount once you develop the habit.

The next time you get a raise, instead of absorbing it into your lifestyle and increasing your spending allowance, I want you to take the exact amount or your new raise each pay period and add it to your mortgage repayment. By all means if your bills increase since them update your budget to reflect that but anything left over can go straight to the mortgage. With each year and each pay rise your repayment should continue to grow!

13. Determine if you can afford your mortgage

If your mortgage is more than 25-30% of your after tax salary you are inevitably going to have a limit on how much extra you can add to your mortgage to pay it off earlier. If you’ve tried all of the above tips and still are struggling to make ends meet or are worried about how you will meet future repayments or interest rate rises this might be the time to consider whether you can afford your current home.

If you do the math and realise that you are can’t afford your keep your home, selling it might be a blessing in disguise and a fresh start. You can use any left over cash from your home to pay off your mortgage and potentially other debts you have and rent an affordable place for a year or two. You can then use that time to save up for a house deposit and start again in a couple of years with a much more manageable mortgage.

Being stressed to the eyeballs day in day out to keep your home is no way to live. And in the mean time whilst you save up for a new home, you can work on getting your income up ready to help you tackle a new mortgage in the not too distant future.

This weeks comment question: What are you doing to pay off your mortgage faster? Let me know in the comments below 🙂

[Photo: Bethany Opler @ Unsplash.com]

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂