It’s that time of the year again, you open the mail (or email ;)) to see a bill for your car registration or insurance renewal staring you in the face. It’s due in three weeks time. What do you do now? Panic? Just chuck it on the credit card? After all, you’ll pay it off gradually over the next year, right? Uh sure… but what about the last three bills you put on that same credit card that you still need to pay off?

That, my friend, is what we call a band-aid solution to your finances and is a surefire way to end up with mounting credit card debt. It’s a quick fix that will only cause you endless stress and anxiety, and throw you into a panic every time you get a new bill. It could be a nightmare for future you. And we don’t want to screw over future you! We want a happy, debt free future you that has the flexibility to travel and go out, and cut back hours at work, doesn’t that sound great?! It sure does to me! So how about instead of continuing down the same old path of panicking every time your car breaks down or you get a new bill in the mail I explain How to Say Goodbye to Financial Anxiety with Sinking Funds.

I was faced with a similar bill shock situation back when I was 21 that changed my approach to finances from that day forward and forced me to think about my financial future.

I had just walked down the driveway to my letter box to check the mail. I saw a letter addressed to me and quickly opened it. To my shock it was a $1200 bill for my car registration and Greenslip renewal. Frick. I had completely forgotten my registration was due. That bill that comes at the same time, every.single.year. I’d only had two of these bills before but hey, it was enough for me to know better. I couldn’t believe that it had completely slipped my mind.

Thankfully at the time I had just enough saved up in my bank account and managed to pay both bills with a little left over to cover the car inspection. However, I now had only $25 to my name to last me until pay day. It wasn’t the end of the world by any means, I still lived at home and would get paid again in a week, but it did mean the small financial safety net (what I’d later learn to be called an Emergency Fund) I had built up for myself was now gone in a split second. I now had no money for petrol, food or anything else for the next week until pay day.

My stress wasn’t over yet. I crossed my fingers hoping the car would pass the inspection as I sat in the waiting area of the mechanics. I knew I didn’t have any more money for any other repairs so needed good news! I held my breath as the mechanic walked over to me to tell me the outcome of the inspection. He told me everything was fine, but he couldn’t pass me. I needed new wiper blades that were going to be an additional $40. Again, not the end of the world by any means, but I didn’t have enough. Had my car needed $1000 worth of repairs I would have been in disaster town. I told him I was down to my last $25 and pleaded for him to pass me, assuring him I’d come back the next day to get them done hoping Mum would spot me some cash, which of course she did, and I went back the next day to get them repaired.

This event was a small financial blip in my adult life but taught me a valuable lesson that changed my financial future. I never wanted to feel that financially insecure again and committed from that moment I would always plan ahead. It was a small moment in my life but made a huge impact.

Have you ever been surprised by a bill or not had the money to pay one? You’re certainly not alone. It doesn’t have to continue to be the norm. The answer to avoiding bill shock is simple and one that you can implement in a matter or minutes. We are going to prepare ahead of time. We know the bills are coming every year or quarter, so why don’t we utilise the time we have to save up in advance and plan ahead for those bills? We can! And this post is going to teach you how to do just that that using a simple budgeting system called Sinking Funds.

Don’t let that term scare you into thinking it will be too much work, or something only finance nerds can manage. It’s going to be easier then you think and I promise, like my financial defining moment, and with a little bit of effort you can say goodbye to financial anxiety too.

The awesome news is you will only have to set up your Sinking Funds once and spend a few minutes a year updating them. The even better news is that once you implement your Sinking Funds you will never have to worry about bill stress again. Yay! Let’s get into it!

Accepting the Reality of Bills

The best thing we can all do for our finances is accept that bills are part of life – the essential ones: water, electricity, health insurance, car insurance, they’ll always be there. Sure there are other, more fun things we could spend our money on but let’s be honest – isn’t having essentials like safe tyres for our car or heating for our homes in winter worth it? Instead of dreading those bills, let’s use our Sinking Funds to prepare ahead of time so they aren’t such a drain on your wallet.

What is a Sinking Fund?

A Sinking Fund is a fancy term for saving up for a future bills such as, your car insurance or your next holiday. Instead of dealing with them as they arrive and trying to cover the cost of your bill out of one or two pay cheques, you can plan ahead for your regular bills and spread the costs over 52 weeks or 12 months of the year. You can set up Sinking Funds for anything you like: Christmas and other gifts; Car insurance; clothing; an annual holiday or to save up for your next quarterly utility bill.

Sinking Funds are similar to a regular savings account but rather than adding to your savings, they are working backwards from the budget expense totals and saving up a portion of that over time. Essentially, you only put away what you need to cover your bills in your sinking fund, whereas with a savings goal your intent would be to grow that savings balance over time above and beyond your expenses.

![]()

Why Do I Need Sinking Funds?

Here are some of the benefits of a sinking fund to help you understand their usefulness in your budget:

- A sinking fund is a way to plan ahead and estimate bills that are due early on, rather then waiting for the bill and eating two minute noodles for the next month;

- They will help you avoid paying bills on the credit card and wracking up large credit card debt at high interest rates;

- They give you piece of mind that if a bills arrives you will have the funds to pay for it. This will reduce budget stress and anxiety;

- They help take the guess work out of budgeting. Once you know your bills are accounted for you know what you have left over that is allowed to be spent rather then spending all your pay check, when in reality some of it should have been put aside;

- You can use them to save up for events like Christmas or vacations to reward your family and make sure there is money put aside to enjoy yourself.

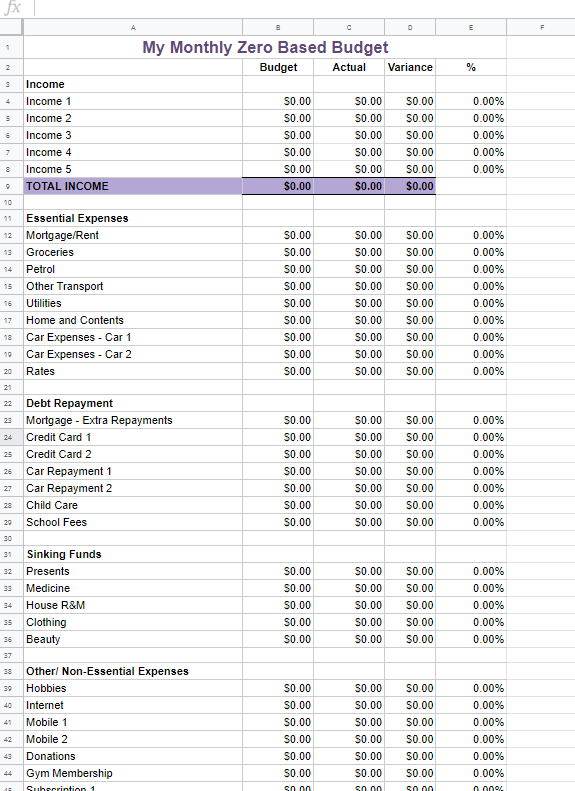

How to Set Up Your Sinking Funds

Here are some simple steps to get you started with your sinking fund:

Step 1: Write a list of all your bills and anything else you want to add (such as a fund for Christmas) during the year. An example has been provided below for you.

Step 2: Write next to the bill a reasonable estimate of each bill or expense for the year. Take note of the bill frequency. If for example, you have a bill paid quarterly, you will need to multiply it by 4 to get the yearly total.

Step 3: Add up the bill totals for the year, write that down and divide that amount by 52 weeks or 12 months depending on your budgeting preference or pay cycle to get your weekly or monthly sinking fund total. This is the amount you will need to put away to cover these costs each period.

Refer to the below table for some category examples.

In this example there are 8 Sinking Fund Categories totaling $15,000 for the year which would require $1,250 a month or $288.46 a week to be set aside to cover the bills as they fall due. In the next step we’ll get your accounts set up.

Setting Up Your Bank Accounts

When setting up your sinking fund accounts there are three options:

Option 1: Keeping all the sinking fund categories in one ‘bills account’ that is exclusively for your sinking fund total

– Pros:

- Only requires one ongoing monthly transfer to be set up to one account

- Monitoring is easier as you can check your balance by logging into one account only

- Can be easily tracked using the Minimise With Me Sinking Fund Worksheet

– Cons:

- Having one bank account with all sinking funds in it means that you won’t know the balance of each individual sinking fund unless you track it in a worksheet or in a workbook

Option 2: Setting up multiple bank accounts for each individual category:

– Pros:

- you can name each bank account according to your category e.g. Christmas, holiday, car expenses and see at a glance what you have in your account for each sinking fund. No need to calculate your balance as it will be the account balance.

– Cons:

- Not all banks let you have such a high number of accounts so you may need to open accounts at multiple banks and have multiple log ins

- This option requires a transfer to be set up to each account so takes a little more work to set up initially, but less ongoing work as you can see the balance at a glance.

Option 3: Cash Envelopes

This third option is for those who prefer to work with cash in their budgets. Simply grab a few envelopes and write on each one what expense category it relates to.

– Pros:

- Great for people who prefer cash and seeing their money or those who want avoid budgeting worksheets

– Cons:

- Putting away $250 or so into a cash envelope you leave lying around at home or in your handbag can be a security risk. This method is best left for the smaller, more frequent bills to limit how much cash you have in your home. Of course you can mix and match with the bank account option and cash envelopes.

Once you have decided on one of the above two bank account set ups or cash envelopes you can open the necessary bank accounts you need.

These accounts should ideally be fee-free accounts. Shop around for your bank account/s to ensure you aren’t paying fees you don’t have to.

Once they are set up, ensure that you use them exclusively for your sinking fund. Do not go and withdraw money for anything that is not included in your sinking fund or you will leave yourself short when they are due.

Take the Work Out of Saving and Automate

Now that your accounts are set up you will need to set up your automatic savings transfers. You need to schedule a regular transfer from your regular transaction account where your pay/s is deposited to your sinking fund account/s for the relevant totals you have listed. Set it to come out the same day every week or month and for the same amount until you cancel it or revise it. Set it for the day after your pay day every week or month. That way the money comes out the day after you are paid, before you can accidentally spend it.

Once these automated transfers are set up you will only need to review them every so often. A quick glance every quarter and adjustment at the end of the year to account for any increases or changes would be ideal.

If you have an irregular income, but are sure that your earnings will cover the total of your transfer each pay period you can go ahead and set it up as an automatic transfer as well. But please note, if your pay is extremely erratic you may want to opt to do this manually instead so your automated payments don’t bounce. A simpler method is just to budget off the minimum you earn so you know you will always have enough coming into the account and save yourself from the manual work. Automated finances are much more convenient.

Build a Buffer

When you first start your fund you are going to be a bit short for some of your sinking fund categories. If for example, you are starting your sinking fund in January and have an annual bill due in March, you are not going to have 12 months to save up for that bill so you will either need to save more for those three months to cover that bill amount e.g. The bill divided by three months or you can start off your sinking fund with a bit of a buffer. A $1000-$2000 Sinking Fund buffer should cover you for any bills you are short for in the first 12 months until you can build up your payments to cover each bill as it is due.

A good tip to get this buffer built up quick is to walk around your house and grab anything you no longer want or use and list it online to sell and get some quick cash that you can pad out your sinking fund account/s with.

Keeping Track of Your Sinking Funds

If you you didn’t opt to have separate accounts for each sinking fund goal and want to keep track of your Sinking Funds in the one account, you can do so by using the Sinking Fund Worksheet which will help you plan out your sinking fund goals, monthly deposits and withdrawals and keep track of each individual sinking fund balance within the one account. It comes with some pre-filled categories to get you started and has plenty of space for you to add your own to suit your lifestyle and budget needs. Simply update the worksheet each month and reconcile it to your Sinking Fund account balance. And that’s it, you now know what your Sinking Fund balances are at any given moment!

If you are finding that you are relying on credit cards or overdrafts to pay your bills, or are in arrears, give the Sinking Fund budgeting method a go and in time your bill woes will be a thing of the past!

This week’s question: Do you use sinking funds in your budget? What happened that made you realise that you needed them? Please share your experience in the comments below 🙂

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()

[Photos: J Kelly Brito & Raw Pixel]