**This post contains affiliate links. If you make a purchase of a product from the links in this post I will receive a small commission, at no cost to you. This allows me to keep my blog advertisement free and support the running costs of my blog. I only recommend products I believe will add value to others and that I love myself.**

For the past couple of years I have read, listened and devoured everything of Dave Ramsey’s that I could find. I have read the Total Money Make Over, Retire Inspired and The Everyday Millionaire**, which have all helped arm me with extremely valuable financial knowledge that has given me guidelines in order to make intentional financial decisions. I’ve also spent countless hours listening to the Dave Ramsey Show to pick up on those nuggets of wisdom that weren’t in The Total Money Makeover.

If you are keen to know some of Dave Ramsey’s Financial Guidelines to Live By on making intentional money decisions and building wealth read on 🙂

Here are 13 of Dave Ramsey’s Financial Guidelines to live by!

SAVINGS

1. Sell everything you own to save up your $1000 Emergency Fund

To start your path to create wealth, the first of Dave Ramsey’s financial guidelines to live by is to sell everything you own: Some great tongue-in-cheek advice from Dave, but worthy nonetheless. You need to get your Baby Step 1 Emergency fund of $1000 saved up quick smart. In order to do this, Dave suggests you sell everything not bolted down in your home ‘:).

Sell whatever you can: your clothes, electronics, furniture, old collections, appliances, decor – whatever you’ve got to boost your Emergency Fund! You’d be surprised about how much money your clutter can make you. Let’s get it done quick! 🙂

Related reading: How I made $5000 from selling my clutter

2. Save up a 3 – 6 month of expenses Emergency Fund before buying a house

Dave Ramsey’s Financial Guidelines on buying a home always suggests you save up a 3-6 month Emergency Fund before buying a home. As Dave says, if you don’t – Murphy will move right on in. When you have a fully funded emergency fund before buying a home you are well placed to deal with emergencies as they come up. If your car breaks down, you need to replace the water heater or pay your insurance excess after a storm – there is no need to panic, you’ve already got a good buffer between you and Murphy.

By all means it will delay your dreams of home ownership by a few months but when you have that piece of mind, that if anything goes wrong you can ride it out, you’ll be glad you did!

You can read more about the Dave Ramsey Baby Steps Here 🙂

3. Don’t invest your Emergency Fund

Every time I hear about anyone talking about trying to invest their Emergency Fund I cringe! As Dave Ramsey’s Financial Guidelines say, this fund is not to be considered an investment and not there for the purpose of making you cash. It is there purely to give you liquid funds in the event of an emergency, a time when you might need cash immediately. You don’t want to go to use your emergency cash that you invested, only to find that half of it has disappeared.

The best you can do is find a good bank with a decent interest rate on savings. Keep your investing funds completely separate. One day you’ll be glad you did!

CARS/VEHICLES

4. Things with motors should add up to less than half your annual salary

Another amazing piece of advice from Dave Ramsey on vehicles. Dave’s rule is that you should never own more than half your household annual income in things with motors in them – that go down in value. This being cars, motor homes, motor cycles, boats and so on!

If you earn $80k and own a $55k truck you have too much money tied up in depreciating assets. You want your money invested in ways to grow it – not eat it up!

Combined Vehicles

Household income > 50% = TIME TO SELL!

Take an assessment of your current vehicle values and add them together. If the total of your vehicles values over your household income is more than 50% of your income it’s time to sell them!

5. Don’t spend more than your car is worth to repair it

One of the best pieces of advice Dave has given on The Dave Ramsey Show is how to know when to repair or replace a car. Dave says to research the market value of the vehicle and not to spend more on the vehicle in order to get it repaired than it’s market value is. For example; if your car is worth $2000 but needs $3000 of repairs you would just sell it.

This is just a guideline to know where to draw the line in the sand on whether to repair a vehicle or not. If you really love the car and it won’t cost much more than the market value to repair it you might be able to still fix the car and keep it but just be ready to let the car go if it is significantly more.

Of course don’t forget to shop around for repairs and get a second opinion which might save you some serious cash and allow you to keep the car after all!

Related post: How Much is Your Car Really Costing You?

HOME BUYING

6. Only buy a house at 25% of your salary or less

Dave Ramsey constantly refers to how people who win with money are debt free including their home. When you don’t have any payments in the world you can make huge steps to build wealth. This is why Dave recommends only getting a mortgage at a max of 25% of your salary.

When you spend more than 25% of your salary on your housing you are minimising what is left to cover other bills, insurances, spending money to enjoy yourself and your savings ability.

Keep your financial stress low by limiting your housing costs to below 25% of your household income.

7. Buy investment properties in cash

There are always people spruiking get rich quick ideas around real estate and borrowing yourself into oblivion.

Dave’s Real Estate approach takes patience and more time to carry out but it covers you for all market conditions. Dave’s advice on Real Estate is to save up for real estate investments in cash! As Dave says, if the market drops or you can’t find a tenant for 6 months you can weather out the storm. Unlike the investor who decided to buy multiple properties with large mortgages who won’t be smiling so much if the market drops.

Related Reading: 14 Things You Should Know Before Buying Your First Home

DEBT

8. Avoiding Student Loans

Dave often reports these words on the Dave Ramsey Show ‘I’ve never told anyone to go into student debt’. But how do you pay for university without student loans?

Here are some wise suggestions from Dave Ramsey to help you avoid going into student debt:

- Start your study at Community College (or TAFE in Australia). These education institutions are a lot more affordable and can give you credits for university study. I saved myself thousands of dollars in student debt by doing my Advanced Diploma in Accounting at TAFE for two years before heading to uni. By the time I got to university I had only 13 of 24 units left to complete of my BA (Accounting) thanks to my advanced standing credits. TAFE at the time I studied was $4000 for the Advanced Diploma vs $800 a subject at university which saved me approximately $6000!

- Study locally so you can live at home or save on interstate fees.

- Go to a less prestigious university. The bigger the name of your uni, the more you are going to have to pay to attend. Unless your parents have offered you a blank check book (and they can truly afford it) attend more affordable universities.

- Save up ahead of time for your student loans. If you have kids you should be saving ahead of time to help them study at university debt free. Investing $10k when your child is born and adding just $100 a month until their 18th birthday could grow to $78,000 thanks to the magic of compound interest (with an average 7% return rate), ready to cover their education costs debt free.

- Apply for scholarships to help you pay for some of the cost of university. The more you apply for, the more change you have of qualifying.

If you don’t have any financial help from your parents you can do the following to avoid student loan debt:

- Save up as much as you can before you start university.

- Considering getting an Internship/Cadetship that will cover your study expenses whilst also training you up in your chosen field.

- Whilst you study, get a job or a side hustle to pay your fees as you go or work like a crazy person during your study breaks. Work out how much you need for the next semester and divide that by how many weeks you have to save up to give you an idea of how many hours or shifts you’ll need to take up.

- Buy second hand text books and sell the prior semester to help you cover any new ones. At $100 plus a pop this can make for some huge savings!

9. Save up and make a cash settlement offer on old debt.

If you have an old debt sitting around that you haven’t make a payment on since who knows when, save up some cash and make them a cash offer on the remaining balance. Dave Ramsey suggests some you might be able to make a cash offer of 5c on the dollar. But even if they will only take 25% of the balance, you are still making a lot of headway!

Don’t forget as Dave recommends to get the offer in writing stating that this will settle the balance in full and close the account and do not give electronic access to your account to the credit company. Write them a cheque. Some very wise words from, Dave!

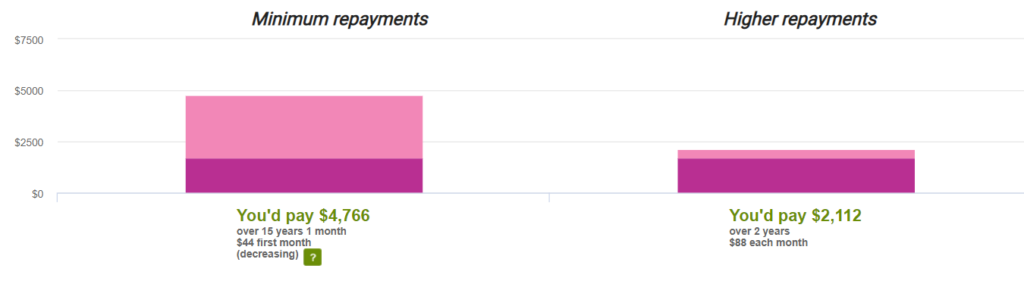

10. When it takes longer than 2 years to be consumer debt free

Dave Ramsey suggests that if you will take more than 2 years to pay off your remaining consumer debt that it is time to get selling. You can either hustle like a crazy person or bail yourself out by selling the car/s, boat, investment properties or your home. Do the rough math as Dave does on his show and work out a rough time line for your debt repayment. If it’s much longer than 24 months, for you sanity it’s probably time to get selling!

Related post: How The Debt Snowball Can Get You Debt Free Faster

RAISING KIDS

11. Pay your children for chores as they are completed

Dave recommends paying your children as they compete tasks in order to show them the direct link between work and being compensated rather then waiting for the end of the week.

Make some chores family duties. Don’t pay your kids for every finger they lift. Make some chores mandatory and uncompensated, to be done for the good of the family such as, setting the table, feeding pets, washing up or making their bed.

12. Support your teenagers in making decisions about their education

Dave Ramsey’s Financial Guidelines include preparing your kids for the future. Don’t leave your teenager on their own to make huge life decisions about their future. Help them to work out what they are good at and passionate about and identify potential career paths.

Research salary averages with them based on level of education and time spent in the industry so you can see a direct link between career path and future income. Weigh up what level of education is needed to achieve that chosen career path and map out a plan with them, where they can afford to study, what course they need to get into their chosen field and how the fees will be paid.

Ensure you consider whether it is worth the investment into a uni degree. Don’t allow your teenager to go into $300k to get a Chiropractor degree if they can only earn $60k-70k. Be sure to shop around for reasonable return on your investment.

13. Teach your kids to Give, Save and Spend

As Dave always says: Live like no one so in the future you can live and give like no one. Starting to teach your kids this well before they leave the nest will help you raise “financially well rounded” kids.

You will hear these three scenarios repeat themselves on The Dave Ramsey Show with callers.

- Some people are extremely generous with their money, and lend money they don’t even have and find themselves in their own financial pickle.

- Others callers are avid savers and feel extreme guilt over spending anything on themselves even once they achieve financial freedom or Millionaire status.

- Then there are the spenders who leave not one dollar to be saved and go beyond and find themselves in ballooning consumer debt.

None of these are ideal financial habits and all can lead you into being taken advantage of, not leading a full and happy life and being miserable and swamped with debt. You can teach your children to have a healthy relationship with money and giving, spending and savings and help them learn valuable skills for when they hit adulthood and save them the troubles that come from not having a good balance.

A great way to do this is to encourage them to split their chore money or anything else they earn into 3 jars: Give, Save and Spend.

It’s a great way to teach them to be kind and compassionate for those who are less fortunate, to teach them that not every dollar should be squirreled away – they need to enjoy some and to not whittle away every last penny either.

[Photo: Michael Longmire @ Unsplash.com]

This weeks comment question: Which of Dave Ramsey’s Financial Guidelines have help you be more intentional with your money?

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()