The Envelope Budgeting Method is a great tool to help you with your Zero Based Budget to stay within your budget. It’s an easy method to track your spending in by category and to keep you informed of when you’ve spent your budgeted amount for a particular expense. If you are struggling to stick to your budget and finding trying to budget blind isn’t working for you, the Envelope Budgeting Method is a great way to give you some control and a birds eye view of your budget expenditure.

Cash Budgeting Envelopes

Generally the Envelope Budgeting Method uses cash that is divided up and placed into separate envelopes with an expense tracker on front of the envelope to tally up your spending as you go. Each time you spend money you would take the cash out of the envelope for the appropriate category, for example, if you were buying groceries you would take cash out of the grocery envelope, you would then note the following on the front of your Grocery Envelope:

- Date

- Store

- Description and

- Amount

You would then calculate what budget you had left over, by subtracting your total budget for the month from what you just spent and entering that amount in the Balance column. You would place your receipt inside the envelope.

I would avoid using cash envelopes to hold large amounts of money i.e. If you are using cash envelopes to save up for your annual Insurance or Car Expenses which might involve leaving hundreds of dollars around the house. For these, I would use a completely separate account for your Sinking Funds where you can put away for larger, ongoing expenses.

Related Post: 10 Easy Tips to Save Money on your Groceries Budget

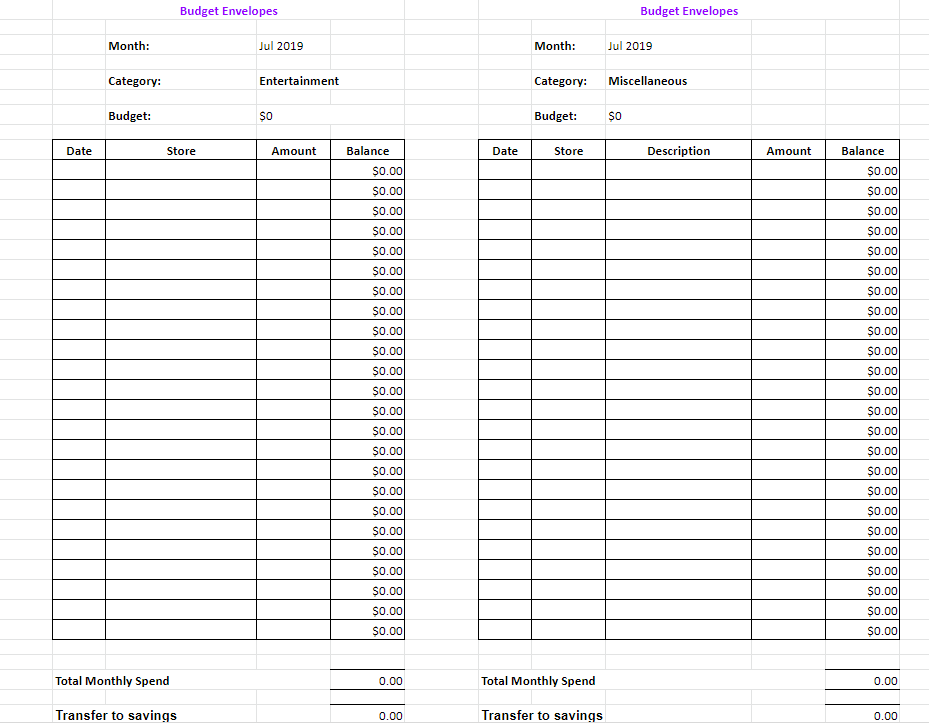

Digital Budgeting Envelopes

I have hacked the Envelope Budgeting Method which usually involves a cash envelope system after giving it a go for a handful of months and created a Digital Budgeting Envelopes which I found suited me more. It is essentially the same concept except it eliminates the need to carry around lots of cash and physical envelopes in your bag. It also eliminates the issue with couples not having access to the envelope when the other partner has it.

To use the Digital Budgeting Envelope you can track your expenditure in the digital envelope file via your Google sheets which you can access from your phone at any time and share with your partner so you can both access and update the same file in real-time.

Again, if you spend money here you would note the Date, Store, Description and the Amount but this time the final balance will calculate for you in the Balance Column.

The Digital Budgeting Envelopes also don’t require you to physically set up the envelopes every month, you simply duplicate the worksheet and just change the month.

Setting up your Envelopes

Cash Envelopes: If you are using the Envelope Budgeting Method with Cash Envelopes you can simply withdraw your cash from your bank account and put the cash into the envelope. Fill in the Category, Month, and Budgeted amount, print off your Envelopes and glue them onto your envelope (110x220mm).

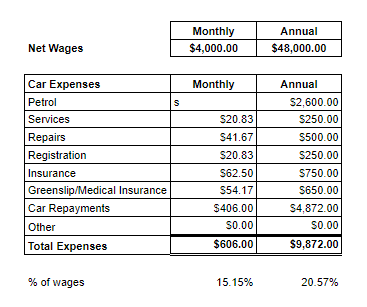

Digital Envelopes: The best way to track your digital envelopes is to set up an account that will be used exclusively for your envelopes budget. For example, if you have 5 envelopes that you want to track and that total budget is $1000 for the month you would transfer $1000 each month to an account exclusively for your envelopes. If your envelopes start on the 1st of the month on the 1st you would deposit your $1000 amount and ideally have at least $1 remaining by the 30th or 31st to show that you are in budget.

What to do with Unspent Budgeted Amounts?

At the end of the month with the Envelope Budgeting Method for both the Cash & Digital Envelopes, the final balance of each Budget Category will be totaled so you can see what is left.

For example, if your monthly grocery budget is $400 and you’ve only spent $360 this month, you could either transfer the $40 to your savings or use it to pay off debt if you have debt, or you can carry that amount across to your next months envelope. So with the cash envelopes you would move the physical $40 into your new envelope for the next month and with your digital envelopes you could just add in a line at the top of your grocery list and just adding carry over from prior month and then adding a -40 and that will add to your total budget so the following month you would actually have $440.

With the cash envelope you would deposit your $40 into your account and move it to your savings or pay it onto Debt. Or you could add the $40 cash into your next month’s envelope, it is totally up to you. If you want to take advantage of being under budget, by all means, put it to good use and save it or put it towards paying off your debt!

With the digital envelope you would simply transfer the money from your envelope bank account to your savings or pay it onto your debt. Alternatively, leave the cash in the account which would carry over to the following months envelope.

Don’t forget to note the movement on your envelopes if you carry the cash over from prior month by adding a $40 into your prior month to show that money is allocated and adding a -$40 into the new months envelope to show that amount has been added to your new months budget for that category. So in this example the following month you would actually have $440 for your groceries budget category.

Related Post: How the Debt Snowball can get you Debt Free Faster!

What if I am Over Budget in a Category?

It’s important to avoid borrowing money from the following month’s envelopes if you are over budget, this is a slippery slope and will become a bad habit you might never catch up with. Instead, borrow within the same month from other categories. In the above example, if you had $40 leftover in your Grocery fund and you wanted to buy some take out later in the month but had used all all your take out budget, you could carry that amount across to your Entertainment Budget. To do so you would add in a line in the Grocery Category: e.g. “Transfer to Entertainment” $40 and in the Entertainment envelope you would add in “Transfer from Groceries” -$40. Make sure to take the money out you enter the amount as a positive and to add it into the other category you pick it up as a negative! Double-check your balance to the right of the entry to make sure you picked up the transfer correctly!

Categories of Budgeting Envelopes

Budgeting envelopes are mainly designed to help you to control your spending in problem spending categories, those categories that aren’t always so easy to stay in budget. For example, you’re probably not going to go nuts buying excess petrol and your electricity bill might increase of decrease with the change of seasons but isn’t really going to blow out in a spending spree. But your clothing budget might and you might easily spend $800 on your groceries instead of the $400 you budgeted, so with the budget envelopes, we want to focus on the more fluctuating expense categories.

The idea is not to have 30 separate envelopes which will be too tedious and for little benefit, the goal is to stick to the main problem spending areas in your budget.

These might be:

- Groceries

- Miscellaneous Spending

- Home Repairs

- Concerts

- Entertainment

- Clothing

- Kids Expenses

- Alcohol

- Beauty

or any other categories relevant to your budget.

Filling in Your Budgeting Envelopes

It does take some getting used to and get into a habit of writing down what you spent as you go and it can sometimes be a nuisance writing down what you’ve spent when you’re trying to battle kids and a grocery trolley through the car park, but there are ways to make the budgeting envelopes work for you. We want to make budgeting work around you, not be onerous and too difficult to maintain!

I came up with a slightly more flexible system that worked for myself with the envelopes. As I spent money, I would stick the receipt in my bag as I exited the grocery store or left the drive-through and then once I got home and unpacked everything, or had a moment spare, I’d then go and grab my receipt and fill in my envelope and record the expenditure.

Another method for people that don’t want to just fill in their envelopes 24/7 is to fill out your envelopes in smaller chunks. To do this I have a small plastic wallet in my handbag where I collate all receipts and once or twice a week I will go through those receipts and add them into my digital budget envelope or cash envelope. I will tick the top of the receipt on any that I have picked up and will also scan the receipt and save it in my Google Drive if it’s a receipt I want to keep a digital record of. Otherwise once I have picked up a receipt if it is for something I don’t need to keep I will just shred or recycle it once I have recorded the expense.

I do recommend when you first start your budgeting envelopes that you do fill them in frequently as you go, rather than chunk as you will be getting to know your budget and your budget limits and it will take a few months to get used to that and if you don’t update them as you spend you might find that you do go over budget, so until you feel confident of your budget, do update your envelopes as you go. Of course, if updating it as you go is your preference then just stick with that.

Storing your Envelopes & Receipts

With the digital budgeting envelopes I would suggest you keep one file for each year. Start a new one at the start of a new year, so you can choose whether you start that in January or July whether you want calendar or financial year. Set up your Google Drive folders or equivalent by expense category e.g. Clothing, Home Repairs, Warranty and so on so you can easily find your scanned receipts when you need them.

With your cash envelopes they will build up over time so I would suggest once every three months you take a photo of the front of any older envelopes for reference and recycle them. Then scan what receipts you wan to keep copies of, e.g. for returns, warranties, or for insurance purposes and shred or recycle the other ones you don’t need to keep like groceries, beauty expenses, etc.

And there you have it how to use envelopes for your budget. And to get you started I have a Cash Budgeting Envelope Printable and a Digital Budgeting Envelope in my store which you can check out. These come with detailed instructions for how to set up your cash or digital envelopes.

Do You Want to Learn How to Spend Your Money With Intention?

If you want to take control of your financial future, stop stressing about money and learn how to spend your money with intention, book in for your free Q&A call to see how Minimise With Me Financial Coaching can help you gain clarity around your finances!

You can learn more about Minimise With Me Financial Coaching services here.

This week’s comment question: Have you ever used budgeting envelopes? Did you find they helped you to stay on budget? Let me know in the comments below!