Buying your first home is an exciting and daunting experience. There’s the fun part, house shopping and looking for your dream home and all the excitement that comes with owning your very own place. And then there is the slightly more scary side of signing a 20 or 30 year mortgage and taking a big step into #adulting.

I remember how overwhelmed and stressed I felt when we were in the process of buying our first home. It happened to be the weekend before my last CPA exam. We had decided to hold off looking at a home until my exams were over so I could concentrate on studying. It was a well thought out, mature plan. Unfortunately that reasoning went out the window and instead of waiting we went house hunting the weekend before my exam when we found a home we liked that was having an open home (it was a hot market, yadda yadda).

Instead of studying, we hopped in the car that Saturday with my (now) In Laws and looked at 7 homes that day. The 6th being the one we put a deposit on later that afternoon. It all happened so fast. We saw the house around 3.30pm and by 5pm we were in the realtor’s office paying our $1000 deposit. It was one of the most stressful weeks of my life. I remember the sheer fear of signing my life away on the dotted line, both on the property and the mortgage documents taking away my freedom for potentially the next 30 years of my life.

Looking back there were some things we did right and a lot of things we did wrong. Of course at the time, filled with excitement and the impending doom of not being able to find a house in our price range and the FOMO we jumped at the chance of getting a home in our budget.

Thankfully it all worked out – I passed my final CPA exam and we managed to buy our home before house prices in Sydney sky rocketed not long after. But we were lucky. With no Emergency Fund in place we could have opened ourselves to a visit from Mr Murphy.

Your home is most likely going to be the biggest purchase of your life so it’s not a decision to take lightly. Your best bet is to prepared and plan ahead! Here are 14 Things To Know Before Buying Your First Home.

1. You should aim to have an Emergency Fund of 3 months expenses saved

Before buying your first home it is important to have a sizable Emergency Fund, ideally 3 months of expenses or more (Dave Ramsey would be proud :)). This will ensure that when your car dies, your hot water system goes or if you have an unexpected job loss that you are prepared financially to weather those storms as they come up relatively stress free.

Life is stressful enough without having to worry about every little thing that breaks or needs to be repaired or replaced. And as a soon to be home owner you should get ready for things to break and need replacing 😉

Of course you might not know exactly what your expenses are if you are moving out for the first time but a reasonable estimate tweaked as you go is better than nothing!

2. Shop around for mortgage rates and low fees

Before you apply for any mortgage shop around for the best rates. Don’t forget to check if there are any establishment fees or monthly fees. Ideally pick one that has no monthly fees, I personally refuse to pay for the privilege of paying a mortgage. To get you started Canstar offers a comparison tool for over 100 lenders.

Related Post: Check out My Top 5 Personal Finance books for what books you need to read to get your finances in order!

3. Get a home loan with a 100% Offset Account

Offset accounts are a great way to reduce your mortgage interest bill without having to actually pay the money on your mortgage. When you are picking a home loan make sure to find one that has a 100% offset account to save you on your monthly interest bill. This will save you some serious cash so don’t glaze over this tip.

The way it works is, any money you have in the offset account linked to your mortgage will offset the interest you pay on your mortgage. So if you had a $200,000 mortgage and you had $10,000 of savings in your offset account, the interest on your mortgage would only be applied to $190,000 of the mortgage not the full balance.

With saving accounts interest rates around the 2.8% mark versus mortgage rates around 4% it is a great way to get more bang for your buck. An added bonus, as the interest savings on your mortgage are not income, they’re tax free savings!

4. Aim for a 20% deposit to avoid LMI

Having a 20% deposit does two things when buying your first home.

a. It allows you to borrow less money and pay less interest over the life of the mortgage. This alone adds up to tens of thousands of dollars saved.

b. It allows you to avoid paying Lenders Mortgage Insurance (LMI) which is insurance that covers your bank from you defaulting on repayments (it does not cover you!) – and it is not cheap! LMI on a $650,000 home with a deposit of 10% would set you back $14508. This is often added to the mortgage balance unless you have the money upfront and will end up costing you $24,918 over a 30 year loan term. The more you can save ahead of buying a home to avoid paying LMI the better!

5. Do your research

Before buying your home you need to do your research. Learn about the area, is there anything you don’t like? Think about why you want to live in that area and if it is suitable for your lifestyle. Look at online listings months ahead of buying to get an idea of what is out there and what you can get for your money, you don’t want to over pay. By looking at a lot of listings you will get an idea of what you do and don’t love in your home.

6. Renting is not dead money

I previously considered rent money as dead money but have since learned that this is not always the case. Renting and saving up for a home deposit is preferable to buying a home you can’t afford and potentially losing it. Saving up for a home and your Emergency Fund takes time and determination and if that means you have to rent a little longer – so be it.

Renting can also help you make more intentional purchasing decisions. Consider renting for 6 months in the area you’d to buy in before you actually buy to get a real feel for if this is an area you want to live for the next 5 + years. Learn what you do and don’t want in a home so you can buy the right house for you. Buying a house is expensive, as is selling one so you want to make sure you are making the right long term decision for you!

Don’t think of rent money as dead money but as money well spent to make sure you are making an informed, intentional decision for your biggest asset. Of course whilst you are renting save any extra that you can on top so you can afford to buy a home one day in the not too distant future 🙂

For more tips on your mortgage check out 14 Realistic Tips to Pay off Your Mortgage Faster

7. Don’t spend more than 25% of your combined gross income on your mortgage repayment

Buying a home with a repayment that is more than 25% of your gross salary (that is after tax) can put a huge financial strain on your budget. By keeping it to 25% of your after tax salary, or as close to that as possible, you give yourself room to cover unexpected costs, and changes in life. Things such as a new baby, a child starting school, a partner wanting to go back to school or needing to upgrade a car are much more affordable when you have room in your budget that isn’t eaten up by a huge mortgage repayment.

8. Know your budget

Before you even look at home or mortgages and what you can afford do a budget. You need to know how much is going in and how much is going out before you can know what mortgage you can afford. Speak to friends and family if you need advice on how much to budget for things like utilities and groceries.

Make sure you add in for those often forgotten budget expenses that might not come up every month like clothing, dental, gifts and car expenses. And don’t forget to make sure you still can save money after paying for all your expenses and mortgage. Ideally you want to still have 10% of each pay check to put into saving or investing. When you know what you can put towards your mortgage, staying close to that 25% goal or less you can look at what you can afford to borrow.

9. Allow for repairs in your budget

A good rule of thumb I learnt from Mr J Money at Budgets are Sexy is to allow for repairs on your home annually at 1% of your homes value. So if your home is valued at $600,000 you should be putting away $6000 annually for any repairs, maintenance or upgrades. That’s $500 a month!

Even at a minimum, you should be allowing $100 a month just to cover costs like small repairs, pest sprays, cleaning, gardening costs and that excludes any upgrades you might want or need.

10. Budget in a buffer for potential rate rises

What your interest rate is today isn’t necessarily what you will be paying next month or in 10 years from now – 30 years is a long time! Know that your rate could go up or down.

This graph below from Trading Economics shows the Australia interest rates all the way back to 1995. Just 10 years ago in 2008 they hit 8%. Ouch!

source: tradingeconomics.com

When I first got my home rates were around 5.4%, they are now at 3.9% thankfully my repayments went down over that time period by more than $100 a week, but can you imagine if they had gone up $100 a week in that same period?

A good rule of thumb when calculating your home budget is to make sure you factor in an increase of 2% on your home loan interest rate. So if you are looking at a mortgage at 4% make sure you can still afford to pay it if it increased to 6% on your current income level. And as mentioned above, ideally at only 25% of your total combined after tax household income.

11. This may not be your forever home

A lot of people get stuck on the concept that this is their forever home which can lead them to hold onto a home that is financially crippling them. By all means houses come with attachments and emotions, I am not immune to that I love our humble abode, but be prepared to downsize or sell up completely and rent for a small period if the need ever arises.

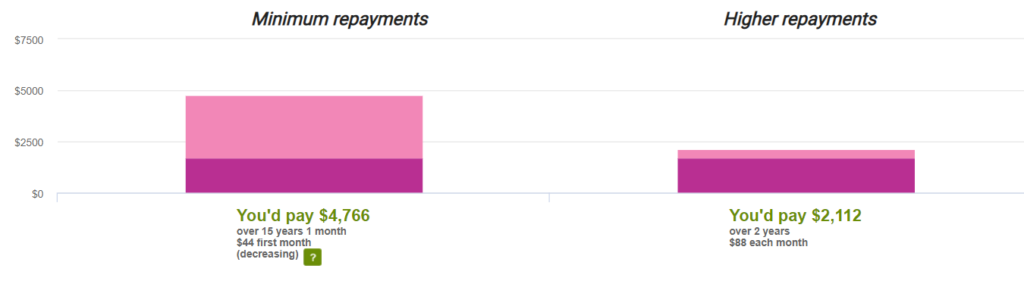

12. You CAN pay your mortgage off sooner than 30 years

Just because your loan term says 30 years doesn’t mean that you need to drag it out that long. Aim to pay off your home within 15-20 years. At least by the time you are 50, giving yourself 15 years to focus on your retirement – but of course, the earlier the better. Check out some tips on how you can pay off your mortgage faster here.

13. Think about the true cost of space

It’s amazing how many people will go out of their way to tack on a $100 a week repayment for the next 20 to 30 years to accommodate once-a-year guests. Or get a more expensive house for the extra storage space rather than just decluttering and having a garage sale. The costs of these do add a lot onto your mortgage so really consider how much you are willing to pay for them. You could be paying an additional $5000 a year, every year to house clutter that you don’t need.

14. Consider the hidden costs

When buying a home there are hidden costs. Sometimes it is something you missed when you were looking at it. For us it was a leaking shower and the space behind the fridge that had not been plastered fully. There are always surprises which may not have been identified at the initial inspection or the building inspection and can end up costing you more than you were expecting.

Then there are the other costs that might just cost you not only money but your time. If you buy the home with the huge back yard are you going to be willing to spend 2 hours every fortnight mowing it? Or are you willing to pay someone $50 to do it for you? Three and a half bathrooms may sounds like a luxury but will you have the time each week to clean an additional set of bathrooms? Will you be able to afford the cost of hiring a cleaner to help out? Can you afford the cost of replacing carpet, or tiling or paying a painter for all that extra space when it comes time for renos? And consider if you are willing to pay the higher utilities bills to have extra space to heat and cool.

The mortgage is by no means the only cost you need to consider so it is important to think of the bigger picture before running with your heart at a home.

[Photo: Dan Gold @ unsplash.com]

This weeks Comment question: Do you have any tips to add when buying your first home? Let us know in the comments!

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()