The past couple of years, I have done a post on the things I did that year to save money, here I am sticking with that tradition, and have compiled a list of the 19 Things I did in 2019 to Save Money to help inspire you with new ways to save your hard-earned cash! Don’t forget to check out my prior post 17 Things I Did in 2017 to Save Money for more ideas on how you can save money! And don’t forget to sign up to the Minimise With Me Mailing list for your free eBook ‘101 Ways to Save Money, Whilst Still Living Awesomely’!

19 Things I Did in 2019 to Save Money

- Saved On Electricity By Using My Utility App

Early in the year, I discovered that my utility company had a handy, dandy app that was super helpful in monitoring Electricity and Gas usage at our home. I downloaded my utility app and monitored it to get electricity use and our bill down. It was great to see how much electricity and gas we used day-to-day and to experiment with how to get it down. I managed to get one of our Electricity quarterly bills down from the initial predicted $550 amount, to a much smaller $400. It’s a great motivator when you can see your bill is going to be high so you can make more of an effort to reduce your bill.

It also allowed me to enter my gas meter reading so the charges would be accurate rather than an estimate.

Some adjustments we made to our electricity use, as a result, were turning off stand-by power, setting our aircon to 24 degrees instead of 18 (I was more than happy as I am not keen on living in Antarctica ;)) and just trying to be more mindful of our power use E.g. Turning off lights that were not necessary and leaving the heater off until it was really needed.

With water restrictions, I am doing my best to save water and money on water.

Estimated savings: $200 a year

2. Resisted Upgrading My Phone Plan

My husband and I have sat on our 15GB data phone plans all year, despite easily being able to quadruple our data for $10 or $20 a month extra but instead, we just made the 15GB plans we had work.

Estimated savings: About $10 each, a month – total $240

3. Taking Advantage Of Big Sales

If I ever need to buy any big ticket items, I do my best to buy those things when they are on sale, such as on June 30 for end-of-year sales or Black Friday.

Of course, we don’t go looking for things to buy, but buy what we specifically want or need. Earlier in the year I was after a new quilt and picked one up from Adairs for 50% off saving $100 (although I would never pay $200 for a quilt ‘:)) and scored some new shoes for 35% off, saving myself $35 and replaced my old jeans with new ones when they had a buy one get one free offer.

And whilst I am there, I do research on as many purchases as I can! You can’t imagine the time I spend researching something that is $60 (it can be annoying to buy things I can’t deny), but at least when I buy something, I know I really need or want it, and it should be a quality product that will last. At least I do my darndest to make sure it is 🙂

Estimated savings: Who knows, would be in the hundreds!

4. Cancelled Our Second Streaming Services

At the start of the year, we were paying for both Netflix and Stan but realised that one is enough. There is only so much time in a day! So we cancelled Stan which was a$10/mth saving. We still have our Netflix subscription, which adds value to our lives regularly, but if we ever find we have nothing we want to watch on that platform, we’ll happily cancel it, or switch it for something else.

Estimated savings: $120 a year

5. Takeaway “Hacking”

I am completely making up the term, takeaway hacking, it’s really just a phrase to describe how we cut our eating out budget by getting takeaway vs dining out, more often. My husband and I both LOVE good food, so one thing we have both said we will justify spending on in our budget, is the food we love! But, there are always ways to save money, so we started finding creative ways to still eat food we love from restaurants, but save at the same time.

Often instead of dining out and paying $55-70 for a meal like we did 1 – 2 times a week in the past, we would instead eat at home. This way we were able to cook our own rice, eat our frozen stash of naans, and have drinks from home saving us about $15-20 a meal. So at least once a week, instead of paying our usual $55 or $75 to dine out, we would get takeaway for $40. This alone has saved us about $780 over the year.

We then ‘hack’ our eating out further by splitting our takeaway into two (or more) meals where we can, for lunch or dinner the next day to make further savings.

And we don’t feel like we are missing out. We skip the issues with slow service, paying top dollar for drinks, and a bit of a personal gripe of mine, paying $8 for the equivalent of $0.50 of rice.

We often buy naans for $13 for a pack of 15, which alone saves us about $8 by having our own naan instead of ordering them each time. We did the same by buying frozen samosas in bulk which cost us a few dollars, instead of the $10 cost of each entree. Of course, we don’t always do this, sometimes we will go out and buy what we want, but it certainly has made us rethink what we order. Now we often get dishes we can share and therefore end up ordering less and will skip the entree on other occasions. And when we eat out, we always ask for a takeaway container so nothing is ever wasted!

Estimated Savings: $780

6. I Brought My Lunch To Work More

Continuing with the food theme, I also upped my bringing my lunch to work game and most weeks did so 2-4 days a week. This saved me about $6 a day! So on a 2 day a week saving alone, this is about $600 a year saving. Not to mention when my husband does the same. He spends a lot more on food in a day, so if I assume, just one lunch was brought from home a week that is another $780 saved 😀

Estimated Savings: $600+780 total of $1380

7. Continuing to Meal Plan

In 2019 we continued with our Meal Planning routine, which has helped us stick to our $400 a month grocery budget.

We haven’t technically saved money here, as we have been doing this for some time, but by sticking to meal planning, we are not spending more money than we needed to on groceries so I think it counts!

Estimated Savings: Nothing extra in 2018, but we aren’t spending more, so yay!

8. Travelling Domestically

We knew we had plans to travel overseas in 2020, so in 2019 we traveled only domestically. Including a staycation in our own city for 3 nights for our 5-year wedding anniversary. We could have spent a lot more, but we decided to instead do something smaller and do some overseas travel in 2020 (Update: Ha! Joke was on us! Our next overseas trip was in Dec of 2022. Splah!).

Estimated Savings: Not having to pay for overseas flights alone would have saved us a pretty penny!

9. Maintaining Our Cars

After years of being slack with car repairs, thinking I was saving money by delaying my service, and just generally being slack at booking in services when I was supposed to, I eventually realised that that is why so many of our cars in the past have died!

I now make sure I service our cars on time and hopefully will avoid any major car issues! We’ve had my husband’s car now for 5 years and mine for 3 so touch wood we can keep them for a lot longer by looking after them! (Update: It’s Dec 2022 and both our cars are still going strong at 11 and 6 years respectively).

Estimated Savings: In the thousands!

10. I Sold More Clutter

Continuing with my prior year clutter selling goals, in 2019 we continued to sell anything that did not add any value to our lives!

Estimated Savings: I actually lost track of this year, but it was at least $500.

11. I Cut My Own Hair

I’ve been dying my own year for years, and this year decided to continue that saving by cutting my own hair. I never liked sitting at hairdressers anyway so not missing out here, and any trip I don’t have to make to the shops is a good thing in my eyes!

Estimated Savings: Approximately $200 a year

12. I Utilised The 7/11 App For Petrol

A friend of mine recommended me the 7/11 petrol app (Australians only sorry!) which has been such a lifesaver! Our petrol now jumps up about 35 cents with the petrol cycle (updated Dec 22: It now jumps up 50c!), so having to fill up on the high days, really hurts your hip pockets! By locking in the cheaper price, we save about $13 for my car’s tank and about $20 for my husband’s. It takes a bit of paying attention to the price cycle and locking in the price at the right time, and remembering to use the voucher before it expires, but the effort is totally worth it when you see your $15 savings! That is some serious cash!

Estimated Savings: Basing it on a fortnightly fill up about $858! I’d estimate it is more though!

13. We Stayed Home More and Thought of New Ways to Have Fun

We have become masters of cheap entertainment! Some of our free & fun activities are:

- Watching comedy or docos on Netflix. Netflix keeps putting up some great stand-up comedy!

- Watching a movie or new TV show

- Playing board games like Rummikub, Scrabble, or our Nintendo Switch

- Going for a late-night walks

- Watching interesting interviews on YT or ones on things to do on our next holiday in our chosen destination.

- Make dessert at home e.g. homemade waffles

We keep outings for things that we really want to do, like seeing a movie we are keen to see or going to see a favourite band play or musical.

Estimated Savings: If we estimate that we save $20 a week on entertainment that’s $1040

14. We Chose to Invest Over Spending

Here’s where that old rule ‘Pay yourself first’ comes into play. We realised how behind the ballgame we were on investing, so in 2019 we prioritised adding to our investments over spending money. When you can save or invest your money, it really takes away from any thoughts you may have about spending everything! Some people feel the urge to spend every last cent, so why not spend it on something that will in time grow your wealth?! We of course spend on things we need or want at times, but do prioritise travel, saving, and investing.

Estimated Savings: Hard to say here, but instead of buying things that depreciate, we are buying things that create a passive income!

15. We Continued To Save All Lump Sums We Got Over The Year

All extra funds on top of our regular salaries – tax refunds, bonuses, pay raises, additional holiday pay, etc were utilised to throw onto our mortgage. We keep 10% in a house fund for updates and the rest goes straight to our mortgage. Again, money we could have eaten up with lifestyle creep or spending and upgrading our electronics and decor, etc, but we chose to pay off debt!

Estimated Savings: Very approximately $3600 a year based on Dec 2018 vs Dec 2019 interest (annually)

16. We Went Digital

We went digital as much as possible saving ourselves on ink and paper costs. No more printing insurance or bank statements, and any statement that cost a fee to be mailed out was negated by switching to e-statements. Not a huge saving here but everything adds up.

Approximate savings: $100

17. I Went to the Dentist More

This is certainly a weird one, but a valuable lesson for us people trying to adult. My husband has a really bad tooth chip in 2019 that he left until the last minute when he was in excruciating pain. Turns out the sooner you go to the dentist, the cheaper the visit is, so like the car service, I am learning prevention is the best medicine and paying $150 for a dental visit is a lot better than paying $1,500 for a root canal (plus – ouch!!!!!!).

I’ve had a very irrational fear of dentists since I was little and am still working on this hehe, but at least now in the back of my head, I have a potentially huge bill to encourage me to make those necessary regular appointments! Now the $150 visits don’t hurt as much either 😉 (December 2022 Update: Pleased to report that I found an amazing dentist and go to the dentist for regular check-ups each year now and my pearly whites are thankful for it!)

Approximate savings: Not sure, but could be lots – and more importantly saving on more severe dental work!

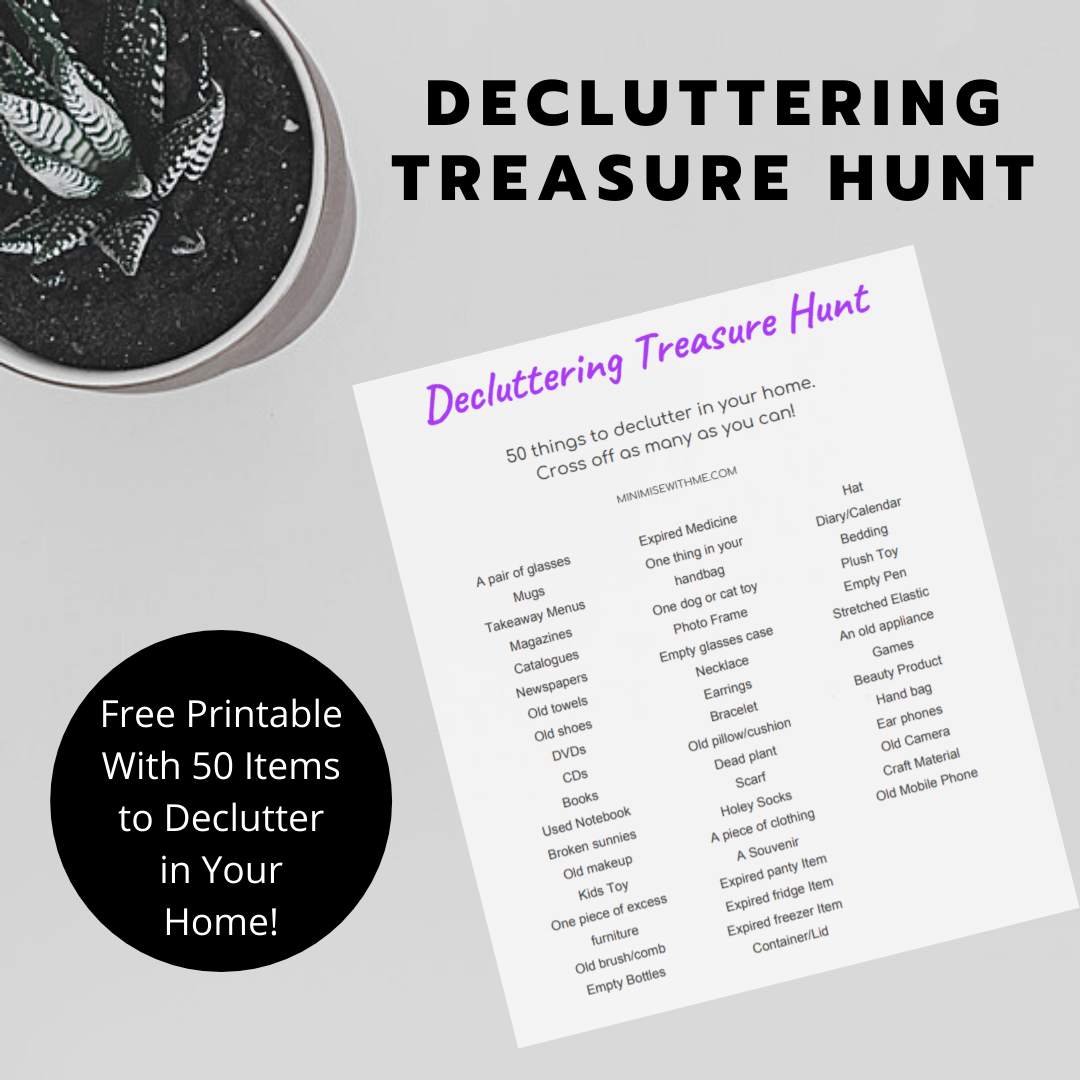

18. I Picked Up a New Side Hustle

In addition to my side hustle of selling unloved clutter, I created an Etsy store to sell organisational printables and budgeting worksheets to help readers of Minimise With Me get organised with their lives and finances! It doesn’t make a lot of money but is an avenue for me to add some income in the future and something I enjoy doing as my passion is to help people minimise stress in their lives and help them on the path to build wealth!

Approximate savings: ???

19. We Went Without

To save money in 2019, we sometimes just went without.

I’ve been wanting a newRobovac for over a year now, but still have not gone out and bought one seeing as our Dyson V8 is still working perfectly fine. Our lounge has a couple of dodgy recliners, but again we have made do as otherwise our lounge still does the job. We have the same television we first bought when we moved in 8 years ago. We could have upgraded to a new smart TV but, instead decided to invest $99 into a Chromecast to make it perfectly functional. We did upgrade some things, like a few pieces of decor and a new dining table but mostly we have just made do with what we had or got creative. I recently sprayed out kitchen handles black for a DIY budget kitchen upgrade and just focus on creating neat and tidy spaces we love rather than spending and upgrading every time there is the urge.

Approximate savings: n/a

[Photo by Crazy nana on Unsplash]

Don’t forget to sign up to the Minimise With Me Mailing list for your free eBook ‘101 Ways to Save Money, Whilst Still Living Awesomely’!

Of course this is all in unison with everything I have done over the prior years, don’t forget to check out my prior post 17 Things I Did in 2017 to Save Money!

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

Question: Which of the above suggestions are you hoping to implement in 2023 to save money? Let me know in the comments 🙂