If you are struggling to pay your bills and constantly going into debt to pay for your expenses, you probably don’t have an Emergency Fund.

Dave Ramsey recommends an emergency fund of 3 to 6 months expenses once you are consumer debt-free to weather unexpected financial costs. It really is as basic as that, cash set aside for emergencies only.

A 2018 Report on the Economic Well-Being of U.S. Households in 2018 found that 40% of those surveyed could not afford a $400 emergency which means a huge number of Americans could be unable to afford urgent expenses like car repairs or medical treatment leading to a lower quality of life.

I would argue that having an Emergency Fund is the single most important financial step. You need a buffer between life and you. And here’s why!

7 Reasons Why You Need an Emergency Fund

- Because shit is always going to hit the fan

Of course, you have heard of the saying when it rains it pours so you should accept the reality that things are not always going to be smooth sailing. Things are going to come up, break down, medical issues can appear, bills can blow out and pinch your budget so the sooner you accept this and prepare for those things in advance the better. As the Economic Well-Being of U.S. Households in 2018 survey found. 40% of respondents said would not have the money to cover a $400 emergency. This should scare you as much as it scares me. Being a daredevil with your finances is going to get you in hot water.

Consider the following scenarios.

- Your car breaks down and it is going to cost $1000 to fix it.

- Your electricity bill came in at $500 instead of the usual $250.

- You chip a tooth and end up needing a root canal that sets you back $1300.

- Your hot water heater dies and you need $1400 in a matter of 24 hours in order to have hot water.

- There’s a storm and both your cars and home have hail damage and you have to pay 3 insurance excesses.

All of the above have happened to me and I am sure you have your own expensive financial stories to tell (Please do let me know them in the comments below!)

Don’t be that person that is in a bind because they didn’t acknowledge life is going to throw you lemons and didn’t make a small sacrifice to save an Emergency Fund.

2. It will stop you from going into Debt

A lot of people don’t bother with Emergency Funds and instead rely on credit cards to finance emergencies. The problem with this is if you are paying for every emergency that comes up with a hefty interest rate, and then only repaying the minimum repayments, before long you are going to wrack up a large amount of debt.

If you are trying to get out of debt you are spinning your wheels paying off debt and then taking more for “emergencies”. If this is you, you may notice that you are not going anyway with your debt goals.

Instead, set yourself a new rule – don’t reach for the credit card to pay for your emergencies. Plan ahead and save up so you can utilise your emergency fund instead when unexpected emergencies appear. You can then use your own cash, it will be interest-free and is there for this exact scenario and completely guilt-free.

3. To ensure you have your basic needs met no matter what

Everyone has basic needs they need to survive. Don’t let your or your family’s basic needs be ignored because you haven’t prioritised and put away an emergency fund. If you or your loved ones have a toothache, your pet needs medication or you need some emergency plumbing, the last thing you want is to not be able to do what you or your family needs. Who wants to deal with a blocked toilet or toothache for longer than necessary because you don’t have the money?

No one wants to miss out on basic needs so don’t let that become a reality. Get yourself an emergency fund as soon as you can!

4. You are a homeowner

This should go without saying, but if you are a homeowner you need an emergency fund. The one truth about housing is there are always costs you don’t expect! Whether it’s paying for an insurance excess, fixing a leaking tap, or an electrical issue, housing emergencies will rear their ugly head at you more than you realise. And they don’t wait for you, sometimes they will even hit you at once. As I mentioned above, we had to pay $2100 in insurance excess for our house and two vehicles that had hail damage, in the same month that our hot water died which set us back another $1300. Had we not been prepared for unexpected house repairs we would have been under a lot of stress to come up with that money in a rush.

5. You have only one stream of income

Even if you are a two-income household if all your income comes from one source E.g your full-time job, it is important that you have an emergency fund to weather any periods of unemployment You hear it in the news all the time, people come into work and are shortly leaving with their belongings after being told they no longer have jobs.

Just imagine for a second how scary it would feel to have just been told you no longer have a job.

Please, don’t wait to find out how crap that shock feels, plan ahead and save up your emergency fund now. Losing your job when you have a few months of expenses stashed away gives you a buffer and time to plan your next steps in your career. And at a time like losing your job, time is what you are going to want.

6. You live away from your family

If you live far away from your family having an emergency fund is a must. You never know when you might need to travel to see your family expectantly. And if there is a family emergency you don’t want to be stuck at home because you’re broke. You’re going to want to be with your loved ones. Make sure at all times you have enough saved to go back home if you ever need to so you don’t have to miss out on being with loved ones at important times.

7. Peace of Mind

Having an emergency is one of the best things you can do for your peace of mind. Life is stressful enough, anything that you can reduce stress and anxiety is a good thing! When you have an emergency fund you know in the back of your mind that you can tackle any unexpected expenses head-on and unexpected issues don’t have to cause you more stress than necessary.

If your tyres need to be replaced, no worries. If your relative is ill and you really need to go and see them, it’s okay you’ve got the money – go and see them! Did you lose your job? Okay, that’s a biggie, but you know that you’ve got some money stashed away for this exact reason and you can afford to cover your bills for some time until you find a new job.

A little bit of planning ahead and sacrifice will pay dividends to you in crucial times and help stem that worry we all have about unexpected costs.

Where should I keep my Emergency Fund?

Your Emergency Fund needs to be somewhere accessible, but not somewhere so accessible that you can spend it. Don’t keep your emergency fund lying around at home in cash. This is a sure-fire way to spend your emergency nest egg on pizza. And don’t invest it in the stock market. you want it to be accessible within 24 hours for emergencies. The safest place to keep your Emergency Fund is in a completely separate bank account (ideally one that is fee-free!) so you can access it as you need it, and it’s going to stay there and not be at the mercy of the stock markets.

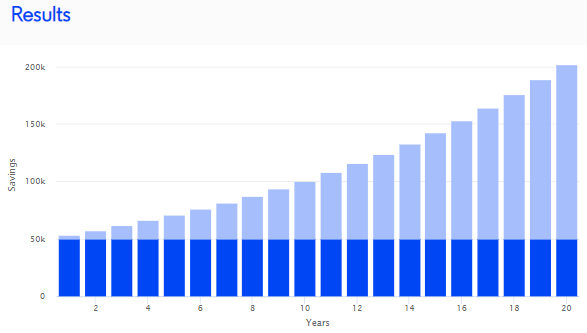

You’re certainly not going to make money off it other than a small amount of interest, but that’s okay. This money isn’t there to make you money it’s there to keep your head above water and be ready to grab if and when you need it. Anything above this amount you can always invest how you choose but keep that outside of your Emergency Fund savings.

How Much of Emergency Fund Should I Have Saved?

This depends on your current scenario. If you have debt other than a mortgage, any of the following:

- Credit Cards

- Car Loans

- Personal Loans

- Medical Bills

- Tax Debts

- Student Loans

- After Pay

or any other consumer debt, I recommend that you have a $2000 emergency fund.

This will give you enough of a cash buffer to cover a car repair or a small house repair and not require you to go into debt to cover any emergencies.

But if you have no consumer debt (go you!) now is the time to boost that emergency fund to 3-6 months of expenses. This is your super-duper Emergency Fund which is going to help you weather bigger financial stresses such as a medical emergency or a job loss. Again, regardless of the balance, leave the Emergency Fund in a bank account – do not invest it. 6 months of expenses may seem like a lot of money to have earning next to no interest but it’s 100% guaranteed to be there ready when you need it.

When is it okay to Use My Emergency Funds?

It’s extremely important that you use some self-restraint when it comes to your emergency fund. It is there for emergencies only.

Needing to go on a shopping spree is not an emergency. Nor is wanting a better car than you have.

You should only use your emergency fund when it is absolutely necessary. Some examples of scenarios where you might use your Emergency Fund are:

- Your car breaks down and you need it to get to work.

- You have a family emergency and need to travel.

- You have a medical issue that requires urgent attention

- You need an urgent house repair (not an upgrade!)

- Your glasses break and you need to replace them.

Of course, when your should use your Emergency Fund is subjective but be realistic, ask if it really is an emergency, or are you just looking for an excuse to dip into some cash?

Here are some scenarios you should resist dipping into your Emergency Fund for:

- You need a new dress for a wedding

- Your friends have asked you to come on a holiday with them

- You really want a new puppy but don’t have the cash

- It’s Christmas and you forgot to save up ahead

- You’re rooms looking a bit drab so you want to buy some new bedding

What happens when I use my Emergency Funds?

When you have used any of your Emergency Fund it is now time to top it back up! Here are a few suggestions for you to do this:

- Put your savings into your Emergency Fund until it hits your goal

- Ask for more overtime at work temporarily until you have saved up enough

- Pick up a Side Hustle to bring in some extra cash

- Sell some of your clutter

- Cut back on expenses in your budget

- Utilise these 101 Savings Tips in my free eBook to create some spare cash in your budget

And there you have it, all you need to know about Emergencies Funds and why you need one!

[Photo: Thought Catalog on Unsplash.com]

Comment Question: When were you in a financial bind and having an Emergency Fund saved you or, not having one caused you stress? Let me know in the comments!

If you found value in this post I would be super appreciative if you could share it with others who might also find value in it 🙂

![]()